As technology, policy and politics change the transportation landscape in Georgia, the state will have to reconsider how it funds transportation infrastructure in the future.

One of the most exciting technological advances is in electric vehicle battery manufacturing. As electric vehicles become more efficient and popular, it will challenge the state’s reliance on per-gallon fuel taxes.

Policymakers must investigate alternatives to fuel taxes for funding Georgia roadways. A transition from per-gallon taxes to per-mile charges will be necessary over the next several decades.

Introduction

The world of transportation is being altered by three sweeping changes: technology, policy, and politics. As these three transform the transportation landscape in Georgia, the state will have to reconsider how it funds transportation infrastructure going forward.

One important technology is electric propulsion. Recent media reports discussed the siting of SK Innovation’s new electric-vehicle (EV) battery manufacturing facility near Commerce, which will make Georgia one of the world’s largest hubs of EV battery manufacturing and “will account for nearly half of our nation’s vitally needed non-captive EV batteries,” Georgia Gov. Brian Kemp announced in March 2021.

The massive hub is expected to draw more EV-related industries to Georgia. Along with a “green” policy push toward EVs from the Biden administration, it is likely to fuel a growing interest in electric vehicle use on Georgia roads and highways.

One challenge this presents is that roads in Georgia and across the nation are largely funded by per-gallon fuel taxes. As technology produces more fuel-efficient vehicles and non-petroleum-fueled vehicles (such as EVs), this reduces the fuel tax revenue that policymakers depend on to pay for roads, bridges, and supporting technology such as electronic toll collection.

The revenue reduction is starting to take place despite increases in vehicle-miles traveled (VMT), population, and the costs of surface transportation infrastructure. Therefore, policymakers must investigate alternatives to fuel taxes for funding Georgia roadways.

The Fuel Tax’s Long History

The mass-market Ford Model T, the first vehicle affordable to the middle class, began production in 1908. Between 1913 and 1927, Ford produced one million of the vehicles, selling them at $850 each. In 1919, Oregon—with 103,418 registered automobiles and trucks on its roads by 1920—became the first state to impose a (one cent per gallon) gasoline tax “for the repair of the damage done to said highways by such vehicles, machines and engines traveling thereon.” By 1925, 35 states were using such a tax; by 1932 all states and the District of Columbia had a gas tax, levied at rates ranging from two cents to seven cents per gallon.

The federal government entered the fuel tax arena in 1932, enacting a one cent per gallon gas tax to help cope with federal funding shortfalls during the Depression. It was not until the Federal Aid Highway Act of 1956, which launched the Interstate Highway System, that the federal gas tax was dedicated to highways (like most state gas taxes). That law also created the federal Highway Trust Fund to safeguard these dedicated fuel tax revenues.

When the Interstate system was nearing completion in the 1970s, instead of repealing or reducing federal fuel taxes, Congress increased the tax rates and expanded the uses of this revenue: first to many other kinds of highways, later to include mass transit, and eventually even sidewalks and bike trails. The federal gas tax was last increased (to 18.4 cents/gallon) in 1993 and has remained at that level ever since. Because Congress has preferred to spend far more than its gas tax brings in, it has regularly “bailed out” the Highway Trust Fund with general fund monies, totaling $157 billion as of 2021.

Current federal policies focus increasingly on eliminating fossil-fuel use, including petroleum-fueled vehicles. As a result, fuel taxes as the primary highway funding source are endangered. Even if increased, they are highly unlikely to provide the revenue necessary for this nation’s future transportation infrastructure needs.

In March 2021 the White House announced President Biden’s $2 trillion “infrastructure” program, including $174 billion for electric vehicle subsidies and technology. And in a May 2021 speech at the Ford Rouge Electric Vehicle Center in Dearborn, Mich., the president reinforced his commitment to EVs: “Look, the future of the auto industry is electric. There’s no turning back.” He added, “Right now, 80 percent of the manufacturing capacity of those batteries is done in China. … We went down to Georgia and took care of that.” His reference was to the SK Innovations battery plant. Biden promised to “set a new pace for electric vehicles.”

But even before this renewed focus on EVs, the diminishing returns on fuel taxes were growing obvious. It’s not for a lack of cars. It’s the increasing fuel efficiency of the fleet. The federal government first enacted Corporate Average Fuel Economy (CAFE) standards in 1975, after the Arab oil embargo. The regulations, aimed at improving fuel economy of cars and light trucks (pickup trucks, vans, and SUVs) produced for sale in the United States, have grown increasingly stringent.

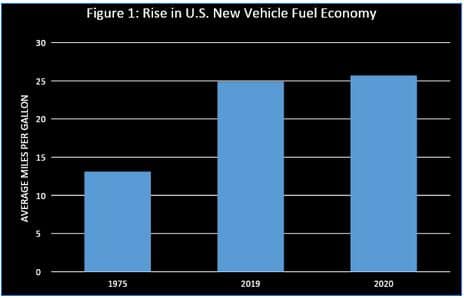

For the 1975 model year, according to data from the federal Environmental Protection Agency, about 10.2 million vehicles were produced with “real-world” average fuel economy of 13.1 miles per gallon (mpg). Real-world means actual highway driving conditions. For model year 2019 (latest data available), 16.1 million vehicles were produced, with average fuel economy at 24.9 mpg. While 2020 model production numbers were not available, the average fuel economy was 25.7 mpg. In other words, while annual vehicle production for 2019 was almost 58% higher than for 1975, the average mpg was a whopping 90% higher in 2019 than in 1975.

In addition, the Biden administration plans to erase (or partially undo) the Trump administration’s relaxed CAFE standards put in place in 2020, which would have taken effect in 2021. The Trump administration’s SAFE Vehicles Rule required auto manufacturers to make 1.5% annual mpg increases through 2026, while Obama-era regulations had required a 5% increase annually. Trump administration standards projected a 40.4 mpg fleetwide average by 2026; the Obama-era rule targeted 54.5 mpg by 2025.

In addition, auto manufacturers are putting increased focus on hybrid and all-electric

vehicles, which use less or no petroleum. This means the revenues generated by fuel taxes

will be declining even as vehicle-miles of travel continue to increase.

In 2005, a special committee of the Transportation Research Board of the National

Academies of Science anticipated this looming challenge, concluding that fuel taxes would not remain viable as the primary highway funding source for the 21st century. (The lead author of this Issue Analysis was a member of the committee.) Congress responded by appointing a National Surface Transportation Infrastructure Financing Commission to consider approaches to longer-term funding for surface transportation.

After considering a large number of alternatives, the Commission concluded:

(1) The original users-pay/users-benefit principle should be retained; and

(2) The best way for users to pay would be a charge per mile driven, rather than per gallon consumed.

It also recommended that the new mileage-based user fees (MBUFs) should be the replacement for fuel taxes, rather than being charged in addition to them.

Since that Commission report, Congress has authorized federal funding for state departments of transportation (DOTs) to carry out a number of pilot projects, under which motorists and truckers operate their vehicles under a simulated MBUF charging mechanism. Most of those pilots have taken place in western states, plus Minnesota. Nearly

all pilot projects in the eastern half of the country have been carried out by The Eastern Transportation (TET) Coalition, formerly known as the I-95 Corridor Coalition. The Georgia Department of Transportation (GDOT) is a member of TET Coalition, a partnership of 17 states and the District of Columbia, but GDOT has not participated in a pilot.

The program furthest along is Oregon’s, whose Road User Fee Pilot Program was begun in 2007.

Building on that—especially related to motorists’ privacy concerns—the Road Usage Charge Pilot Program (RUCPP) was implemented in 2012–2013. In 2015, Oregon’s legislature authorized an ongoing, voluntary program called OReGo, open to up to 5,000 people who could opt to pay a per-mile charge instead of the state fuel tax. All revenue was dedicated to highway and bridge purposes.

In 2019, Oregon Gov. Kate Brown signed legislation to remove the 5,000-person cap, opening the program to all owners of vehicles getting at least 20 mpg. Currently, the charge is 1.8 cents per mile, to raise the same average revenue per vehicle as current state fuel taxes. The law calls for adjusting the per-mile charge to keep pace with any subsequent increases in fuel tax rates, for as long as state fuel taxes remain in effect. During the (probably lengthy) transition period, each vehicle will pay either the state fuel tax or the state Road Usage Charge—not both.

As explained in the 2017 final report on Oregon’s Road Usage Charge,

Road usage charging re-aligns transportation funding with road use—drivers pay for what they use, just as they pay for each kilowatt of electricity used at home. For each mile driven, a driver contributes 1.5 cents, regardless of rural or urban location or whether the vehicle’s fuel efficiency is 150 mpg or 20 mpg. Basing each driver’s contribution on miles driven is equitable and sustainable.

This Issue Analysis focuses on a per-mile charge as one way that policymakers might address the looming highway-funding challenge in Georgia. First, it provides estimates of the likely shrinkage of fuel sales over the next 30 years. Then it discusses the general lack of awareness among some policymakers and especially the general public about the shrinking-fuel tax problem and the potential of an alternative that charges users by the mile. Following that, this analysis suggests a policy framework for how such a system might be developed and implemented in Georgia. It would build on systems already in place or planned for portions of the state’s major highways.

The Predictable Decline in Georgia’s Gasoline Use

Fuel tax receipts nationwide have begun what is expected to be a long-term decline over the next three decades, at both the federal and state level. In fiscal year 2019, a period of robust economic growth, federal gas tax receipts declined by nearly 1%. Although the COVID-19 lockdown exacerbated the downward trend in FY 2020, reports show receipts declined only 2.1% from 2019; experts suggest this was most likely due to a delay in reporting and expect much lower receipts once adjustments are made. Continued declines can be expected because travel patterns—especially for work-related travel—may not return to previous highs as many workers continue to work from home or from outside metro areas (part-time or full-time) instead of traveling in to work on a daily basis.

Until 2015, Georgia had a two-part gas tax: a 7.5 cents per gallon excise tax and a 4% state sales tax. Fuel was also subject to local-option sales taxes, which ranged

between 3% and 4% in most places. In 2015 the legislature converted to a motor fuel excise tax largely because taxing as a percentage of the purchase price led to fluctuations in revenue as gas prices changed, causing uncertainty in funding. The law also mandated an annual fee for EV owners.

On July 1, 2015, the tax was converted to a 26 cents per gallon state motor fuel excise tax on gasoline and 29 cents per gallon on diesel. Local sales taxes continued to apply, with a $3 cap on the average retail sales amount used to calculate the prepaid local tax rate. Through 2025, the law directs the state Department of Revenue to calculate the rate thus:

The Department will perform an annual calculation of fuel efficiency by calculating the change in average miles per gallon of new model year vehicles from the previous year. This percentage change will be multiplied by the current state motor fuel excise tax rate. The excise tax rate adjusted by the change in fuel efficiency will then be multiplied by the annual percentage change in the Consumer Price Index.

Georgia’s gasoline excise tax for 2021 is 28.7 cents per gallon. The diesel excise tax is 32.2 cents per gallon. The motor fuel excise tax does not include local government sales-and-use taxes on the “average retail sales prices” of motor fuels, which change every year on January 1 and July 1. Local sales tax rates add 2%–4.5% to the price of fuel.

Georgia’s gasoline sales, at their strongest in 2017, have declined steadily since then, with a 6.57% plunge in sales in 2020. That aberration appears to be pandemic-related: Vehicle-miles traveled in 2020 dropped 8.29% compared with the year before.

Diesel sales, on the other hand, increased almost 3% in 2020, an indication of the increased use of trucks for freight and deliveries across and through Georgia during the pandemic. Additionally, trucks have not yet had to cope with such stringent new-vehicle fuel-economy mandates as passenger vehicles. However, the Environmental Protection Agency is developing increased truck fuel-economy regulations, and all major truck manufacturers are developing heavy-duty electric trucks. Consequently, future diesel tax revenues are also expected to decline.

In recent years, transportation researchers have estimated the extent and rate of decline likely to take place, both nationwide and in Georgia. Using calculations by Ed Regan of the transportation consulting firm CDM Smith, this Issue Analysis quantifies both national and Georgia-specific increases in passenger vehicle fuel efficiency, changes in gallons of gasoline sold, and potential impacts on gas tax revenue.

Regan’s calculations are based on two national forecasts that are applied to Georgia.

- The Energy Information Administration’s (EIA) projection through 2050 (in their 2021 Annual Energy Outlook) including annual estimates of the fuel efficiency of the passenger vehicle fleet as new, high-mpg vehicles are purchased and replace older low-mpg vehicles. From this it is possible to project estimated gasoline gallons consumed.

- The Bloomberg New Energy Finance (BNEF) global projection of market penetration of EVs as new vehicle sales, which Regan adapted to better reflect U.S. conditions, and which would lead to further reduction in gasoline gallons sold.

In addition, to using the latest “reference case” EIA assumptions on future fuel efficiency, Regan created two additional alternative scenarios. One assumes that part of the previous administration’s more-aggressive future CAFE standards would be restored under the Biden administration, which is now under way. The other reflects a considerably higher EV penetration adapted from the Bloomberg NEF forecasts.

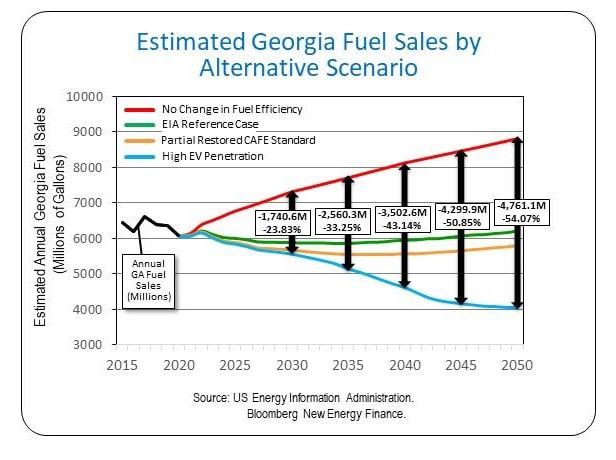

Figure 2 shows several alternative scenarios for Georgia fuel sales from 2020 to 2050.

The red (top) line in the figure is the estimated fuel sales revenue that would be generated if fuel economy remained constant—a hypothetical projection for comparison purposes, which ignores CAFE standards and likely EV growth.

The green line below it is the estimate of reduced fuel sales based directly on the latest EIA reference case fuel efficiency assumptions, which reflect current (Trump administration) federal CAFE standards, which mandate ongoing increases in new-vehicle mpg through 2025.

The orange line reflects fuel sales if the Biden administration restores some of the CAFE standards that the Trump administration relaxed in 2020.

The blue line reflects the additional impact of BNEF’s projected higher EV sales, which further reduces gasoline sales. As can be seen, under this scenario, Georgia’s annual fuel sales would be 3.5 billion gallons less than a status-quo projection by 2040 and 4.7 billion gallons less by 2050.

What is depicted in Figure 2 is probably a conservative projection, for several reasons. The 2021 forecast by the EIA assumes lower “new car” and “average fleet” fuel efficiency projections than previously, because it is based on Trump administration-era CAFE standards (from fall 2020). The Biden administration, as noted earlier, plans to restore at least partially the Obama-era CAFE standards, and Figure 2 calculations provide for an alternative to the Trump-era EIA projection (Partial Restored CAFE Standard). Congress is expected to mandate further increases in new-vehicle fuel-economy for the years after 2025, which will further reduce gallons sold and hence gas tax revenue, but that is not included in Figure 2, since it is impossible to know what Congress may mandate. In addition, by the 2030s it is widely expected that electric trucks’ market share will increase, reducing revenue from diesel-fueled trucks and further reducing overall gasoline and diesel sales.

Obviously, this significant reduction in fuel sales will negatively impact motor fuel tax revenues in the state. Offsetting these future revenue losses through fuel tax rate increases may be a serious challenge. Georgia has already established indexing of fuel tax rates, both to offset annual inflation and to at least partially offset the revenue impacts of increasing average fuel efficiency. But this may lead to very high fuel tax rates in coming decades.

If there were no change in fuel efficiency (see red curve in Figure 2), and assuming an average annual inflation rate of 2% per year, gasoline tax rates would need to increase from $0.287 per gallon in 2021 to about $0.379 by 2035 and around $0.51 per gallon by 2050, per Regan’s calculations. But the increasing fuel efficiency projected by EIA (and the alternative that assumes partial restoration of prior CAFE standards), suggests gas tax rates between $0.51 and $0.55 per gallon by 2035, and between $0.76 and $0.84 per gallon by 2050. Factoring in the BNEV projection of EV market penetration leads to gas taxes as high as $1.38 per gallon by 2050. These estimates assume that indexing continues indefinitely, even though the current indexing policy extends only to 2025.

The biggest impacts in the future, however, will result from the expected shift to battery electric and/or plug-in hybrid vehicles, which consume little or no gasoline. Recognizing this, the state has also introduced a supplemental annual fee, at the time of vehicle registration, for battery-electric and plug-in hybrid vehicles. This fee is currently set at $213.70 per year for non-commercial alternative fuel vehicles and is adjusted annually for inflation. This is intended to replace fuel tax revenues from those vehicles that effectively use little or no fuel. Similar programs are being introduced or considered in other states. The National Conference of State Legislatures reported that 28 states charge EV fees as of the end of 2020.

Today, there are about 28,000 registered alternative fuel vehicles in Georgia, about 0.3% of the approximately nine million vehicles registered in the state. This is expected to increase significantly in the future, and under the “high EV” scenario could reach 40% of the total vehicles in the state by 2050. Assuming the EV registration fee program were to continue, adjusted for inflation annually, the program might fill one-third to two-thirds of the future revenue gap, depending on the actual shift toward electric vehicles that occurs in the future.

However, the current program does have some important limitations. For example, the fee would only apply to Georgia registered vehicles; some portion of alternative fuel vehicles driving in the state may be registered outside the state and no revenue would be derived from them. But more importantly, the annual EV fee program moves away from the basic user fee principle inherent in the traditional motor fuel tax. That is, the more miles a vehicle is driven the more fuel it consumes and the more fuel tax it must pay. For these and other reasons, some states are implementing (or considering) a mileage-based user fee (MBUF) for electric vehicles, initially as an optional alternative to a flat-rate EV charge.

Those very large increases in gas taxes discussed previously would leave the growing population of electric vehicles paying far less than gas-propelled vehicles toward the cost of maintaining, widening, rebuilding, and enhancing Georgia’s highways, as these roadways experience up to 30% more traffic over the next three decades. The growing inequity of that outcome is one of the reasons that many transportation experts favor replacing the per-gallon tax with a per-mile charge.

What Americans Currently Think About Mileage-Based User Fees (MBUFs)

Currently, many Americans have a negative impression of per-mile charges. When asked by survey researchers about possible future highway funding sources, only about one-quarter of the public sees per-mile charges as a good idea. One reason for this may be privacy concerns, as media articles suggest the government would mandate a box in every vehicle that “tracks” when and where everyone travels: “Big Brother in your car.” Few drivers consider how closely they already are tracked by their own vehicle’s electronics as well as their insurance companies and their smartphones.

Suspicious taxpayer groups seem certain that a per-mile charge would not replace the gas tax, as intended, but would become yet another tax. And, as the steady increase in federal fuel taxes over the decades demonstrates, they can hardly be faulted for not trusting government’s intentions.

Furthermore, anti-automobile/anti-highway activists, seeking to discourage driving, would like any per-mile charge to include additional taxes on emissions, noise, and other impacts of driving. Americans who appreciate the freedom and flexibility of the automobile and the nation’s wide-open spaces are inclined to see the switch to being charged per mile as a threat to their mobility.

While Georgia legislators have seen presentations on pilot mileage-based user fee (MBUF) projects, they have shown little interest in this approach, perhaps because the legislature’s 2015 decision to switch to a CPI-adjusted fuel excise tax reduced immediate concerns.

Fortunately, the numerous pilot projects under way have improved understanding of what an MBUF system would actually look like. Nearly all the pilot projects:

- Gave participants a choice of several methods to record their miles traveled, and for how those miles would be reported to the government.

- Did not “track” or report the time and place of every trip made.

- Used private, third-party companies to handle the reporting of miles to the government.

- Calculated how miuch participants would have paid and compared that to the state gas tax they had actually paid for the miles driven during the test.

- Made clear that a state MBUF would replace the state fuel tax, not be charged in addition to it.

- Made use of stringent privacy protections for the mileage information collected.

Several pilot projects actively recruited public officials to be among the participants, which gave those officials first-hand experience with how it worked. In general, most participants in the pilot projects came away with a positive view of the case to switch to per-mile charges.

A public education component is essential to the success of such a program. Some state DOTs focus on MBUFs solely as a way to fix their looming revenue shortfall, rather than on the overall benefits of such a change. When average people hear that the government needs more revenue, they tend to tighten the grip on their wallets. While the revenue shortfall is very real, motorists and trucking companies deserve to see a genuine value proposition in making a major switch in highway funding.

In a 2019 Reason Foundation policy paper, the lead author of this Issue Analysis suggested two elements of such a value proposition:

- Fix all the shortcomings of the 100-year-old gas tax, not just its coming revenue shortfall; and,

- Begin the transition with something that offers large, visible benefits to highway users.

The next two sections of this Issue Analysis expand upon those ideas.

Fixing All the Gas Tax’s Shortcomings

Most proposals to replace the gas tax with a per-mile charge focus only on its declining revenues, since an increasingly large fraction of vehicles will be using less or zero gasoline in coming decades. But this 100-year-old tax has three other shortcomings. If Georgia and other states replace the fuel tax with a better funding source (a challenging undertaking), it makes sense to see if the MBUF can be designed to fix the other shortcomings as well. Here is a brief explanation of the other three shortcomings in Georgia.

#1 Gas taxes don’t keep pace with roadway needs.

Georgia’s motor fuel excise tax is adjusted to the fuel-efficiency standards published in the U.S. Department of Energy Fuel Economy Guide and indexed through 2025 to the Consumer Price Index. The increasing traffic in Georgia, which added one million residents in the past decade, requires a larger fraction of highway budgets to be spent on widening existing corridors, rebuilding and enhancing aging ones, and increased maintenance. Charging all vehicles per mile driven will help highway funding keep pace with the growth in Georgia’s population and roadway travel.

#2 Gas taxes are not transparent.

For other vital infrastructure (electricity, water, telecommunications, etc.), consumers receive a bill from the provider. It reports how much the customer used, the rate per “unit” of use, and the total the customer owes. The customer sees what he or she used and the basis for the charges, and also knows who the provider is. With highways and other roads, how much the customer paid and the identity of the provider are obscure. In his book, Rethinking America’s Highways, the lead author of this Issue Analysis found that several years ago the average U.S. household paid just $46 per month in federal plus state gas taxes, far less than for any of the other utilities (e.g., for electricity the national average was $107 per month). Further, Americans have no idea who provides which roadways and therefore whom to hold accountable for problems. Many people even believe the federal government owns the Interstate highways, when in fact the states own and operate them.

#3 Gas taxes are a one-size-fits-all method of charging.

In Georgia, drivers pay an average of 1.3 cents per mile driven. That is the same whether someone drives solely on local streets and roads or mostly on freeways and other major highways. The cost of building and maintaining freeways is several times as much as for local streets. On the other hand, 1.3 cents per mile is far more than is needed for local streets and two-lane rural roads. With this way of paying for roads, the people who use rural and local roads pay more than those roads cost, while those who use expressways pay less than they cost. That is not equitable.

Instead, imagine starting with a clean sheet of paper to design a per-mile charge system that addresses all the above shortcomings, making it more like paying a utility bill than the current tax. It would have the following attributes:

- A true user fee, paid only by those who use roadways and spent only on roadways;

- Equitable to all users, with different rates for major highways (Interstates and expressways) and other roadways;

- Transparent, making it clear which provider is responsible for which roadways; and,

- Subject to periodic increases, when justified by increased operating and capital costs, via a public process similar to rate-setting for other utilities.

Starting the Transition via Major Highway Improvements

The Georgia Department of Transportation (GDOT) is understandably concerned about the looming decline in gas tax revenues, and legislators are likewise becoming aware of the magnitude of this problem. However, taxpayers and voters in 21st-century America tend to be hostile to calls for increasing government revenue. Already, in some states where MBUF pilot programs have been carried out, some grass-roots groups have attacked the idea as “just another tax increase.”

GDOT and others concerned about the future of Georgia’s highways should not make revenue shortfalls the primary rationale for the needed transition from per-gallon taxes to per-mile charges. Rather, the focus should be the need for major investment in the state’s aging and heavily used highway system, which must be upgraded to accommodate Georgia’s projected population growth over the next three decades.

The core of Georgia’s highway system is the limited-access highways: long-distance Interstates, the stressed and crowded urban freeway system in metro Atlanta, and the beginning of an Atlanta metro area network of express toll lanes. Except for short stretches of express toll lanes on I-85 and I-75, Georgia’s more than 1,250 route-miles of Interstate are overwhelmingly not tolled. Toll lanes are scheduled for construction on I-285 beginning in 2023.

The Interstate system was authorized in 1956, and most of its corridors were built in the 1960s and early 1970s. That makes most of the system 50 years old or older, well beyond its original design life. Georgia has rebuilt and widened portions of its Interstate system and continues to work on reconstruction and widening.

In the 2015 FAST Act, Congress asked the Transportation Research Board (TRB) of the National Academies of Science to convene an expert committee to study the future of the nation’s Interstate system. The committee’s 596-page report was released in December 2018. Among its main findings were the following:

- Much of the Interstate pavement is wearing out and needs to be replaced.

- The system has numerous bottleneck interchanges that are obsolete and should be replaced.

- There are not enough lanes in many corridors for projected growth in motorist and truck travel in coming decades.

- The system could benefit from dedicated truck lanes in some key freight corridors, but there are none. (A project in the development phase on I-75 near Macon would provide 41 miles of dedicated lanes for northbound trucks.)

In its major report to Congress, the TRB committee suggested a repeat of the original 90% federally funded Interstate highway program, which it estimated would require raising and spending an average of $57 billion per year for the next 20 years (totaling about $1.1 trillion). Doing so would necessitate a massive increase in federal gasoline and diesel taxes, which is highly unlikely. The committee’s report also discussed the possibility of financing this huge set of projects based on projected toll revenues, which would require amending the 1956 federal law to permit the use of tolls on the 90% of the Interstate system where tolling is not allowed.

A 2019 Reason Foundation policy study responded to the TRB committee’s report, recommending the toll-financed approach to rebuilding and selective widening. It also proposed expanding an existing three-state pilot program to allow any state that decided to take this approach to use it to begin the transition from per-gallon taxes to per-mile charges.

In Georgia, this could be done along the following lines. GDOT would first study the five major (primary) non-tolled Interstate corridors (I-16, I-20, I-75, I-85, and I-95), assessing the age and condition of each, along with its need for widening, and by which decade reconstruction and/or widening would be needed. This would lead to a long-term plan spelling out which segments of each of the Interstates would be rebuilt (and widened, if needed) and when. One by one, each corridor’s improvements would be designed, financed (via toll revenue bonds), and rebuilt as needed.

As each corridor was finished and re-opened to traffic, motorists and truckers would pay new per-mile tolls instead of state gasoline and diesel taxes. The Peach Pass tolling system would calculate the amount of fuel each customer used driving the rebuilt corridor (based on the vehicle make and model plus its EPA highway fuel economy rating), and software would calculate rebates of the state fuel taxes still in place for all other roads. This would demonstrate to people that the new per-mile charge was the replacement for the fuel tax.

Via this process, over several decades, almost 30% of all vehicle-miles of travel in Georgia would be converted from per-gallon to per-mile, with no users paying both fuel taxes and per-mile charges for the same roadway.

Starting with limited-access highways (where there are only a few places to get on and get off) means that the transition to per-mile charging can begin by making use of existing technology—the Peach Pass system, consisting of windshield-mounted transponders supplemented by license-plate imaging. This avoids the need for near-term decisions about any new technology that would be needed in cars and trucks to enable per-mile charging for open-access roadways, such as US 441 and US 27, numerous state-numbered highways such as SR 120 and SR 138, as well as local streets. Equipping all those other roadways for charging via the Peach Pass transponder would require many thousands of gantries to record vehicles’ passage, which would be far too costly (and unsightly).

The initial program outlined here—for limited-access highways only—would build public confidence that per-mile charges would indeed replace per-gallon taxes, as each corridor was rebuilt and opened with the new charges and rebates of the fuel tax paid for driving those miles. Highway user tax rebates like this are already being provided to trucking companies that use the Massachusetts Turnpike and the New York Thruway, both of which are tolled Interstates. The rebate process has been automated by trucking service provider Bestpass, which offers trucking companies a 48-state universal toll transponder and consolidated billing service. Thus, highway user tax rebates are not simply a theory; they are in actual practice in two states.

How to Transition All Other Roadways to Per-Mile Charges

Ultimately, as gas tax revenue continues to decline, Georgia and other states should plan to phase out this tax altogether and replace it with per-mile charges statewide. Converting the limited-access highways first will provide breathing room, because as each segment of an Interstate or other limited-access highway is converted to per-mile charges, that portion of the state’s overall highway system will become self-supporting and will no longer consume a portion of the declining revenue from fuel taxes. Gas tax revenues will no longer have to cover the ongoing maintenance of those corridors and, more importantly, will not have to be used to rebuild and widen those corridors that have been converted.

As noted previously, the Peach Pass system would not work for the open-access state highways (which include critically important urban arterials). Nor would it work for local streets and roads. But if the limited-access highways are converted first, Georgia will have many years to learn from state pilot projects and to experiment with customer-friendly ways for roadway users to record and report their other miles of travel.

Georgia has not yet carried out a pilot project to test various features of a state mileage-based user fee, but should plan to do so in the relatively near future. In designing such a project, the state can take advantage of what has been learned by states that have already implemented one or more MBUF pilot projects. Here is a brief summary of key features that have been well-received by participants in MBUF pilot projects elsewhere:

- Keep it simple and understandable: a user fee to pay for roads.

- Replace the state gas tax, rather than adding the fee on top of that tax.

- Make it fair to both rural and urban users, including lower per-mile charges for rural roads.

- Make it transparent and self-explanatory, as with utility bills.

- Use private firms, selected competitively, to handle collecting, processing, and protecting miles-traveled data.

- Legislate strict privacy protections for miles-traveled data.

Among the options for recording miles of travel that have been offered to participants in state pilot projects are the following:

- Annual odometer readings at the time of vehicle-registration renewal;

- An all-you-can-drive option under which the annual charge would equal what the vehicle would owe for driving twice the average number of miles driven per vehicle in that state;

- An on-board unit that plugs into the OBD-II port beneath a vehicle’s dashboard and records miles driven, and if certain location information is needed (e.g., if some miles are driven across a state or county border), those miles are identified using cell-tower data; and,

- An on-board unit that uses GPS to provide more precise location data than are available by using cell-tower data.

Speaking of GPS, it is important to note that the GPS system of satellites does not “track” anyone. GPS signals permit the vehicle’s computer or its operator to know where the vehicle is at any given time, but that receiver cannot transmit data to anyone. The miles-driven information is stored on the vehicle and can only be uploaded (using a separate transmitter) if that is what the customer signed up for. This is very much like the GPS receiver in a smartphone, which lets the phone’s owner know his or her device location at any time but does not transmit that information to anyone else without the owner’s permission. Regardless of which method of reporting miles is used, stringent privacy protection for that data must be ensured by statute.

Assuming Georgia has begun the transition to per-mile charging using the Peach Pass system on all the limited-access highways, that system will handle the revenue collection for all those miles of travel. That would be more than one-quarter—28.2%—of all the vehicle-miles of travel (VMT) in the state. The next challenge is how to charge for the remaining VMT driven on two different categories of roadway: those with state highway numbers that are managed and maintained by GDOT, and the remaining roads that are the responsibility of cities and counties. Table 1 breaks down the VMT by roadway provider.

Georgia Vehicle-Miles of Travel by Type of Roadway (2019)

| Category | VMT (millions) | Percent |

| Limited Access Highways | ||

| Interstates, rural | 8,114 | |

| Interstates, urban | 25,484 | |

| Other freeways and expressways, urban | 3,911 | |

| Subtotal: | 37,509 | 28.2% |

| State Highways and Arterials | ||

| Other principal arterials, rural | 6,414 | |

| Other principal arterials, urban | 17,726 | |

| Minor arterials, rural | 5,916 | |

| Minor arterials, urban | 21,325 | |

| Major collectors, rural | 5,715 | |

| Subtotal: | 57,096 | 42,9% |

| Local Roadways | ||

| Minor collectors, rural | 1,186 | |

| Local roads, rural | 4,465 | |

| Major collectors, urban | 8,764 | |

| Minor collectors, urban | 567 | |

| Local roads, urban | 23,539 | |

| Subtotal: | 38,521 | 28.9% |

| Total Georgia VMT | 133,126 | 100.0% |

Since it is desirable to include greater roadway-provider accountability to highway customers in the new roadway payment system, ideally, it would be possible to calculate how many miles each vehicle traveled on state roads and how many on local roads. Unless all vehicles used a very precise system, such as GPS, that could distinguish between these road types, that would not be a realistic goal. But a second-best approach is available.

A state agency—either GDOT or the Georgia Department of Revenue’s Division of Motor Vehicles—could identify all the VMT in each county (and subtract the amount driven and already paid for via Peach Pass on the limited-access highways) by type of road owner. For simplicity, just divide this between state highways located in that county and the remaining city/county roads. GDOT would prepare its annual budget for the state highways and calculate the rate per mile needed for the coming year, subject to regulatory approval. That budget could then be divided among the GDOT districts, as is done today. A similar process would take place eventually at the county level, supplanting a local or regional transportation special-purpose local option sales tax (T-SPLOST).

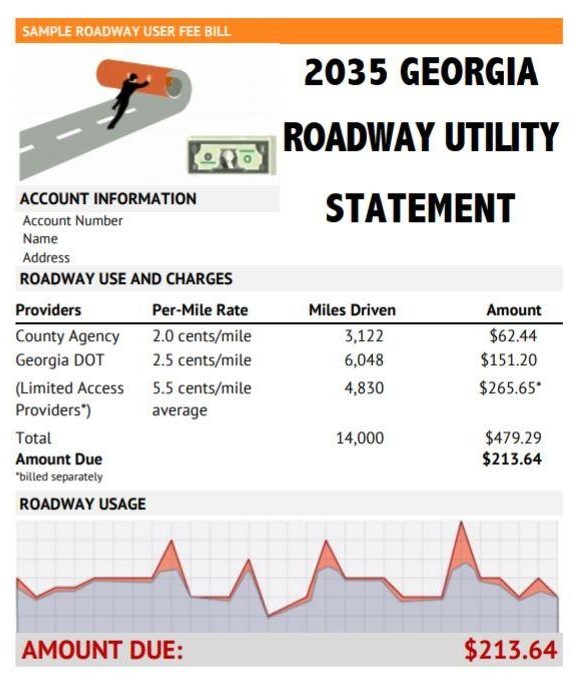

The aim is to provide a transparent system under which roadway customers know who provides which set of roads they use, what they charge per mile traveled, and therefore what they must pay, like the utility bills everyone is familiar with. Figure 3 provides a hypothetical Roadway Utility Statement. This concept assumes an annual statement comparable to property tax bills, but it would also be possible for people to pay their highway bills in quarterly or monthly installments.

Conclusion and Recommendations

Over the course of the past decade, Georgia transportation policy has failed to fully account for the impending decline in revenue from per-gallon gasoline and diesel taxes. Although the state has held EVs accountable through its 2015 transportation legislation, imposing an inflation-adjusted annual fee, Georgia has not directly participated in any of the pilot programs created by Congress to allow states to experiment with mileage-based user fees. Western and midwestern states, and eastern states along the I-95 corridor (excluding Georgia and Florida) did develop MBUF pilot projects and have learned a great deal about how such a program might work.

This Issue Analysis has argued that a transition from per-gallon taxes to per-mile charges will be necessary over the next several decades. It has also recommended that in designing such a program for Georgia, the objective should be not merely to replace the revenue that fuel taxes have traditionally provided, but also to fix a number of other current shortcomings of fuel taxes. These include lack of transparency, lack of accountability of road providers to road users, and the fact that the fuel tax is a tax rather than a true user fee like utility bills.

Any switch-over from gas taxes to mileage-based user fees will necessarily be gradual. This Issue Analysis recommends beginning the transition with Georgia’s limited-access highways, where an increasing number are slated to add express toll lanes. The charging system is the toll lanes’ Peach Pass system, which could be extended to non-tolled Interstates and freeways as those highways are modernized over the next two decades. The charges to use limited-access system should be stated on a per-mile basis. And customers paying these new electronic per-mile charges should be given rebates for the amount of fuel taxes they have incurred for the miles driven on the per-mile-charged limited-access system. When this step is completed, about 28% of Georgia’s vehicle-miles of travel will have been transitioned from paying per-gallon to paying per-mile. Customers will receive regular statements documenting the miles they drove and the amounts they were charged via mileage-based user fees.

Once success has been sufficiently demonstrated in the transition of limited-access highways, Georgia should move to the next step: planning the transition of state and local roadways to a per-mile charging system. As success is shown in other systems—including Oregon, Utah, Virginia, and others—Georgia can learn and benefit from their experiences. By the time serious implementation planning is underway in Georgia, many of the kinks will be worked out elsewhere. Road-user-charging technology will have advanced, and a number of states that have participated in MBUF pilot projects can be expected to be “paving the way” with statewide systems in the early stages of implementation.

In the near term, state transportation policymakers should prioritize two important next steps. First, drawing on the findings of the Transportation Research Board’s landmark study on the future of the nation’s Interstates, Georgia should undertake a study of the need for modernizing the limited-access system (including reconstruction, replacement of bottleneck interchanges, and widening where needed). This study should be done corridor by corridor, and should result in cost estimates and timeframes for various projects. The feasibility of financing these projects based on bonding the revenue streams should be an integral part of this study (or studies). Similar statewide studies have been carried out by Connecticut, Indiana and Wisconsin, with another study under way as of 2021 in Michigan.

Second, Georgia should seek to join the latest phase of TET Coalition’s mileage-based user fee pilot project. The first two phases have involved the state DOTs of Delaware, New Jersey, North Carolina, Pennsylvania, and Virginia, with participation from motorists and trucking companies. Southeastern states Georgia and Florida were not participants. Active participation in the ongoing TET Coalition pilot project would give Georgia motorists, truckers, media, and policymakers direct exposure to the MBUF methods and technologies current today, as a starting point to consider longer-term implementation.

In addition, should any measure be introduced in Congress that would reduce or eliminate the 1956 ban on using tolls on the 90% of the Interstate system that is non-tolled, Georgia policymakers should strongly support such a measure. The success of GDOT’s growing express toll lanes program can be just the beginning for Georgia’s Interstates and set the stage for MBUF in the state’s future.