Taxes & Spending

Featured Publication Chapter

Tax Reform

Taxes should be designed to raise revenue to fund necessary government programs and should focus on consumption rather than income.

Read More

October 17, 2024 • Blog

What is Amendment 1?

Georgians will vote on a ballot initiative designed to bring property tax relief. We look at the referendum and its implications.

October 17, 2024 • Commentary

The implications of Amendment 1

What would be the implications of adopting Amendment 1, a measure adopted by the legislature to provide property tax relief?

October 17, 2024 • Commentary

Would Amendment 1 bring property tax relief?

Voters this year will see a statewide ballot referendum on property taxes. Will it bring relief?

October 3, 2024 • Commentary

Why a guide to the issues?

The Georgia Public Policy Foundation has released its 2024 “Guide to the Issues.”

August 15, 2024 • Commentary

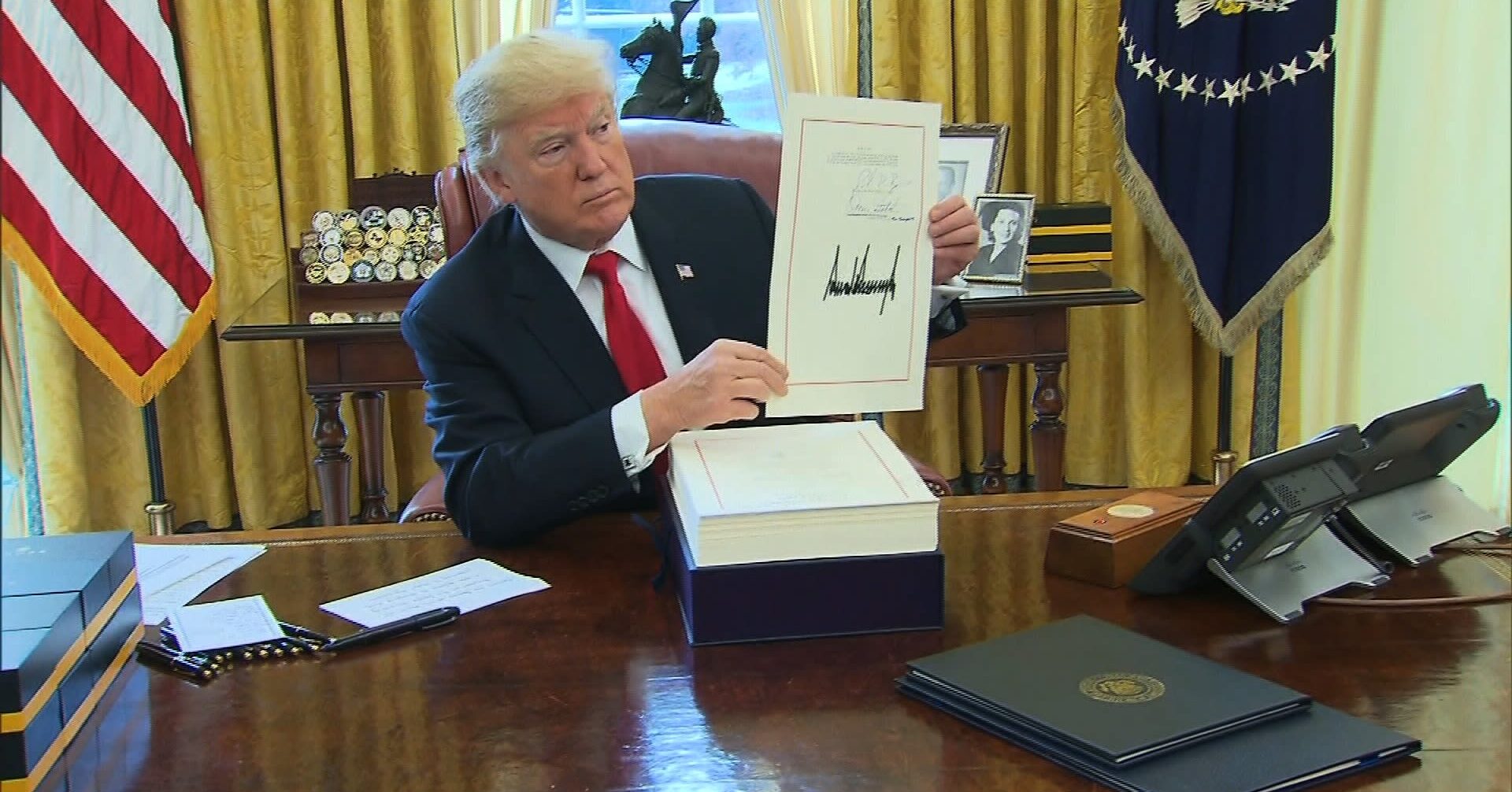

How did the Tax Cuts and Jobs Act simplify the tax code?

If the individual provisions of the Tax Cuts and Jobs Act expire at the end of next year, tax filing will get more complicated for millions of Americans.

June 26, 2024 • Commentary

Trump and Biden should address our national debt

President Joe Biden and former President Donald Trump hold their first presidential debate in Atlanta this week.

April 25, 2024 • Commentary

Is this Georgia fee still constitutional?

Until recently, impact fees were believed to be immune from attacks under the Takings Clause of the United States Constitution. What has changed?

April 22, 2024 • Commentary

Georgia should seize the opportunity for deeper tax cuts

Lawmakers continue to cut, albeit in a manner befitting the third word in the state’s motto: Wisdom, Justice, Moderation.

April 4, 2024 • Commentary

What happened with property tax reform this year?

This truly seemed like one of those legislative sessions when everything was aligned for meaningful property tax reform.

February 7, 2024 • Commentary

Prudent tax reforms are more than welcome

Is there any relief in sight to growing property tax bills?

January 25, 2024 • Commentary

Will the Georgia legislature cap property tax increases?

Perhaps no public policy debate raises the ire of Georgians quite like property taxes.

January 10, 2024 • Blog

Braves departure from Mississippi was predictable

The Braves announced this week that the Double-A affiliate will be moving from Pearl, Mississippi to Columbus, Georgia.

January 10, 2024 • Blog

This “could” be a big legislative session

While every session of the General Assembly – like every election – is billed as consequential, this time the hype could be right.

December 27, 2023 • Blog

11 biggest stories of 2023

As we prepare to welcome in a new year, here is a review of our most read and most shared stories of 2023.

December 6, 2023 • Commentary

Time to redraw our economic future

States across the nation have been moving aggressively to position themselves as business-friendly through lower tax rates. Georgia needs to join them.

Friday Facts

For more than two decades, the Georgia Public Policy Foundation had published Friday Facts every Friday.

We provide the latest news from Georgia, commentary on the top issues of the day and the latest updates from the Foundation.

Stay informed by signing up below.