Principles:

- Minimize the impact of taxes on economic growth. Taxes are necessary to fund core government services, but every additional dollar of taxes is a discretionary dollar taken away from a family. A decision to raise taxes is an explicit decision that a government program has a higher priority and importance than individual decisions. The private sector is the source of all wealth, and is what drives improvements in the standard of living in a market-based economy. Taxes should consume as small a portion of income as possible, should not interfere with economic growth and investment and should not place the state at a competitive disadvantage.

- Limit exemptions to encourage a broad tax base and low rates. Exemptions shift the tax burden onto others. High tax rates distort economic decision-making. Everyone who is financially able should pay some tax to support the necessary services they receive from government. Voting to grow government spending is easy if you don’t have to pay for it.

- Focus taxation on consumption rather than savings and investment. If you tax something, you get less of it. Taxing income is a tax on work, savings and investment. As the Special Council on Tax Reform and Fairness for Georgians stated in its final report, economists generally agree economic growth occurs in a tax system that “taxes consumption rather than income in order to encourage saving and investment.”

- Avoid picking winners and losers. Tax policy should not single out individuals, products, businesses or particular groups for preferential treatment. Taxes should be designed to raise revenue to fund necessary government programs, not to micromanage economic decisions in a complex economy.

- Ensure fairness. While everyone who utilizes government services should pay some tax, excessive tax burdens on those at the lower end of the income scale should be avoided. In addition, individuals in similar situations should be taxed similarly.

- Encourage simplicity and stability. Complex tax codes increase the costs of compliance and enforcement and encourage tax avoidance schemes. Tax changes should be permanent and not temporary or retroactive.

Recommendation:

- Reduce tax rates by broadening the base of the income and sales tax rates.

Facts:

Sales Tax Base: Historically, sales taxes are applied to goods unless exempted while services are exempted unless specifically included by the tax code. Economists agree that there is no economic reason to treat goods and services differently. In fact, all products are a combination of a good and a service. Government purchases should also not be exempt because government often competes with private companies that must collect sales tax.

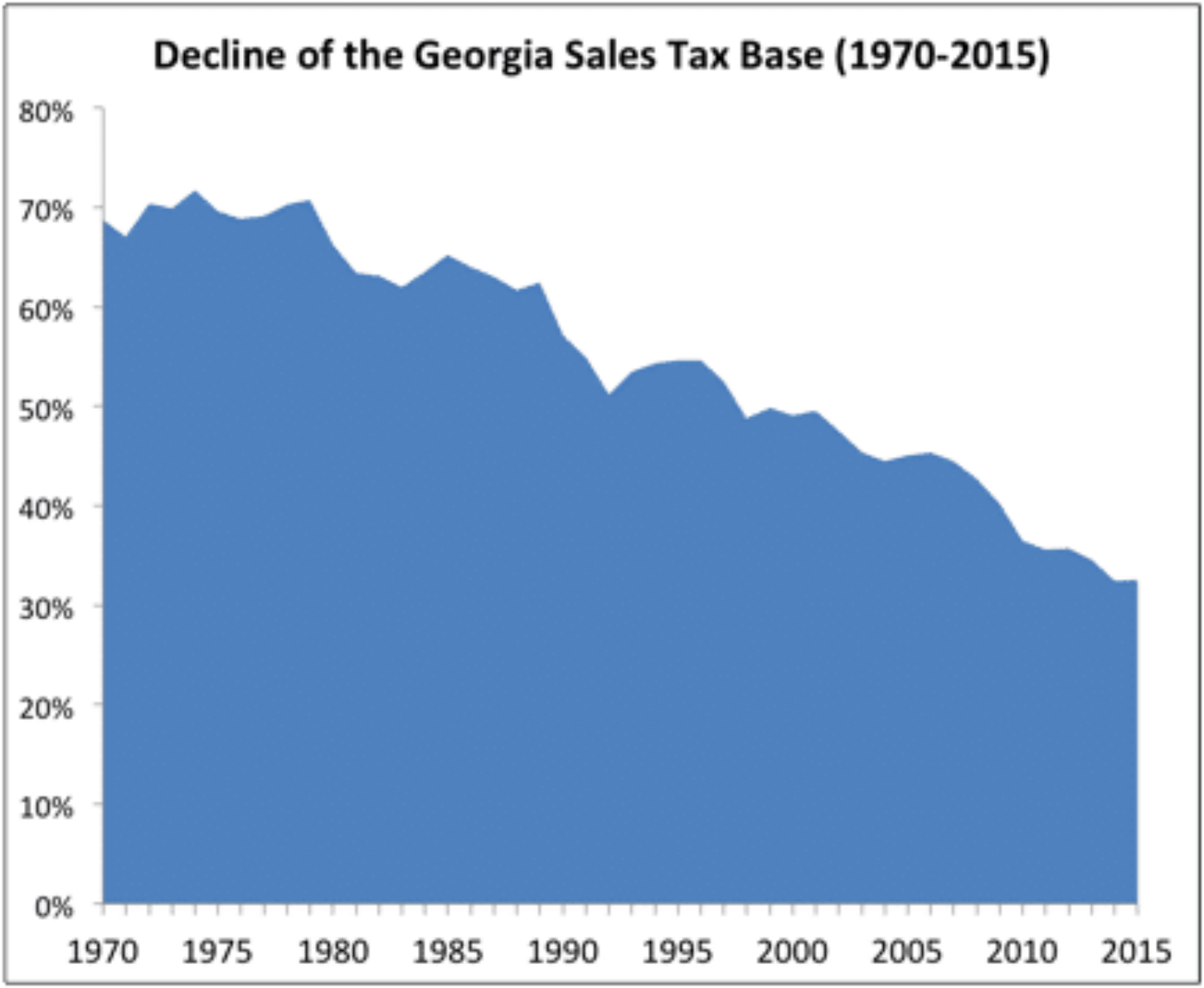

The accompanying chart shows the steady decline of the Georgia sales tax base over time as a percentage of personal income. Taxing most goods and services at the retail level would more than double Georgia’s sales tax base.[1]

Personal Income Tax Base: Exemptions include the standard deduction, itemized deductions, personal exemptions and retirement income of up to $130,000 per couple. Eliminating these exemptions would increase taxable income by approximately 40 percent.[2]

More than half of all business income nationally is taxed through the individual income tax, not the corporate income tax. That’s because more than nine out of 10 businesses are organized as “pass-throughs” – Partnerships, Sole Proprietorships or S Corporations. That amounts to more than 800,000 small businesses in Georgia.

The nearby table, based on a study by Georgia State University, demonstrates how broadening the sales tax base to include groceries and services enhances growth and reduces volatility.[3]

Overview

An almost universally held principle of good tax reform is the goal of broadening the tax base and lowering tax rates. Economists also generally agree that taxing consumption is preferable to taxing income.

| Broadening Sales Tax Base Enhances Growth and Lowers Volatility | ||

| Growth | Volatility | |

| No Groceries or Services | 4.13 | 23.12 |

| Add Groceries | 4.05 | 15.78 |

| Add Services | 4.41 | 5.34 |

Small businesses, and start-up companies in particular, are critical to job growth. Without startups, there would be no net job growth in the U.S. economy, according to a study by the Kauffman Foundation. “From 1977 to 2005, existing companies were net job destroyers, losing 1 million net jobs per year. In contrast, new businesses in their first year added an average of 3 million jobs annually.”

Just as important are the entrepreneurs behind those start-up companies. Gallup CEO Jim Clifton has noted that the technology build-out that led to the $10 trillion of unplanned revenue growth over the last 25 years in the United States can be traced to about 1,000 innovators and entrepreneurs.[4]

Georgia has made strides in developing its start-up ecosystem over the last five years, but still loses too many young startups due to a lack of capital. How do you fix that? As former Citicorp CEO famously noted, “Capital goes where it’s welcome and stays where it’s well treated.”

|

28 States with Personal Income Tax Rates Lower Than Georgia |

| Alaska – 0% Florida – 0% Nevada – 0% New Hampshire – 0%* South Dakota – 0% Tennessee – 0%* Texas – 0% Washington – 0% Wyoming – 0% Pennsylvania – 3.07% North Dakota – 3.22% Indiana – 3.3% Illinois – 3.75% Michigan – 4.25% Arizona – 4.54% Kansas – 4.6% Colorado – 4.63% New Mexico – 4.9% Alabama – 5% Mississippi – 5% Utah – 5% Massachusetts – 5.15% Oklahoma – 5.25% Ohio – 5.33% North Carolina – 5.499%** Maryland – 5.75% Virginia – 5.75 Rhode Island – 5.99% Georgia – 6% Kentucky – 6% Louisiana – 6% Missouri – 6% |

| * NH and TN currently tax interest and dividends only (not wages). TN passed legislation in 2016 to completely phase out the personal income tax.

** NC rate effective 2017 |

When entrepreneurs choose to move to Florida, for example, to escape Georgia’s 6 percent income tax, Georgia doesn’t just lose the tax revenue on the sale of the entrepreneur’s business and the tax on his or her earnings. Also lost is their community leadership, their philanthropic giving and the mentoring and investment in the next generation of entrepreneurs.

For business owners, states like Florida and Texas (no tax) are just an airport away. Tennessee (6 percent on dividends and interest income) and North Carolina (5.75 percent income tax and dropping) are a short drive away. It’s easy for the wealthy and retirees to relocate their homes and wealth beyond Georgia’s tax reach. Further, Georgia’s rate reduces its regional competitiveness, leading the state to offer more tax incentives to lure new business.

Second, taxing individuals’ income stifles job creation, because the majority of business income is taxed through the individual income tax.

More important, taxing what individuals earn is a huge disincentive to productivity, business expansion and job creation. Taxing individuals’ income unfairly penalizes people who save more, work more and earn more.

In reality, the income tax is not a tax on the wealthy; it’s a tax on becoming wealthy. The wealthy can hire professional advisors to help them find loopholes and tax shelters. They can purchase non-taxable investments, time their income streams or just spend six months of the year in Florida. It’s the working class that gets stuck paying the bulk of income taxes, which limits their ability to accumulate wealth.

Georgia could use a boost to its economy. According to a study by the Federal Reserve Bank of Atlanta, “If long-term growth rates seem too low relative to other states, lowering aggregate state and local marginal tax rates is likely to have a positive effect on long-term growth rates.” This is exactly the problem facing Georgia.

As measured by gross state product, the state’s economy has grown more slowly from 2002 to 2012 than all but eight states. Tax reform is not the threat to Georgia’s future. Maintaining the status quo is.

Recommendation: Broaden the base of the income and sales tax and reduce tax rates

The method of accomplishing this goal is more of a political decision than a policy issue.

Benefits:

- Simple: Fewer deductions and exemptions would improve administration and compliance.

- Pro-growth: Taxes on work, savings and investment could be dramatically reduced, resulting in more jobs and higher disposable income for families.

- Competitive: Lower tax rates would give Georgia a competitive advantage.

- Stable: A broader tax base will be more stable during recessions, reducing the need for emergency spending cuts, and the tax base will grow more quickly, allowing the state to fully fund core government programs.

- Fair: Low-income families will face better job opportunities in a growing economy and all products will be taxed at the same low rate. A refundable tax credit could be created to offset significant tax increases on low-income families.

Several options have been studied.

The Special Council on Tax Reform and Fairness for Georgians recommended eliminating most of the current exemptions in the individual income tax code.[5] Another proposal would limit itemized deductions to charitable contributions and up to $20,000 of mortgage interest. This would allow the top personal income tax rate to be reduced to 5.25 percent.[6]

On the sales tax side, the Council recommended expanding the sales tax base to groceries and services that are already taxed in a large number of states. (Gov. Zell Miller phased out the state sales tax on groceries in the 1990s, but local sales taxes were not removed.)

The FairTax is a retail sales tax applied to nearly all goods and services. In studies prepared for the Georgia Senate Fair Tax Study Committee, the Fiscal Research Center at Georgia State University estimated that eliminating the personal and corporate income tax and incorporating a state FairTax with a rate of 6.42 percent would result in no loss of income to the state and would lower the tax burden for most low-income families.[7] A more recent study by the Beacon Hill Institute found a FairTax rate of 5.4 percent would be sufficient.[8] Georgia’s current sales tax rate is 4 percent and local sales taxes add an additional 2-4 percent. With the additional local revenue from a FairTax, local sales tax rates and/or property taxes could be reduced.

[1] Fiscal Research Center, Georgia State University, reports prepared for the Georgia Senate Fair Tax Study Committee, September – November 2013, “Analysis of Alternative Consumption Tax Structures for Georgia,” September 2013, http://cslf.gsu.edu/files/2014/06/analysis_of_alternative_consumption_tax_structures_for_georgia.pdf

[2] Georgia Tax Expenditure Report, 2014, http://www.open.georgia.gov/rsa/taxrpt/viewMain.aud

[3] “Georgia’s Tax Portfolio: Present and Future,” Ray D. Nelson, Georgia State University Fiscal Research Center, September 2012, http://frc.gsu.edu/sites/default/files/documents/Rpt%20247FIN%281%29.pdf

[4] “Global Migration Patterns and Job Creation,” Jim Clifton, Chairman and CEO of Gallup, 2007, http://bit.ly/1NzTmab

[5] http://www.terry.uga.edu/media/documents/selig/georgia-tax-reform.pdf

[6] Policy Memorandum, Fiscal Research Center, Georgia State University, November 2013, page 5, http://bit.ly/1qXh4IM

[7] Ibid.

[8] The Beacon Hill Institute for Public Policy Research. “A State FairTax for Georgia,” August 2015, https://www.gafairtax.org/wp-content/uploads/2015/04/Beacon-Hill-Rate-Study-2015-08.pdf

Principles:

- Minimize the impact of taxes on economic growth. Taxes are necessary to fund core government services, but every additional dollar of taxes is a discretionary dollar taken away from a family. A decision to raise taxes is an explicit decision that a government program has a higher priority and importance than individual decisions. The private sector is the source of all wealth, and is what drives improvements in the standard of living in a market-based economy. Taxes should consume as small a portion of income as possible, should not interfere with economic growth and investment and should not place the state at a competitive disadvantage.

- Limit exemptions to encourage a broad tax base and low rates. Exemptions shift the tax burden onto others. High tax rates distort economic decision-making. Everyone who is financially able should pay some tax to support the necessary services they receive from government. Voting to grow government spending is easy if you don’t have to pay for it.

- Focus taxation on consumption rather than savings and investment. If you tax something, you get less of it. Taxing income is a tax on work, savings and investment. As the Special Council on Tax Reform and Fairness for Georgians stated in its final report, economists generally agree economic growth occurs in a tax system that “taxes consumption rather than income in order to encourage saving and investment.”

- Avoid picking winners and losers. Tax policy should not single out individuals, products, businesses or particular groups for preferential treatment. Taxes should be designed to raise revenue to fund necessary government programs, not to micromanage economic decisions in a complex economy.

- Ensure fairness. While everyone who utilizes government services should pay some tax, excessive tax burdens on those at the lower end of the income scale should be avoided. In addition, individuals in similar situations should be taxed similarly.

- Encourage simplicity and stability. Complex tax codes increase the costs of compliance and enforcement and encourage tax avoidance schemes. Tax changes should be permanent and not temporary or retroactive.

Recommendation:

- Reduce tax rates by broadening the base of the income and sales tax rates.

Facts:

Sales Tax Base: Historically, sales taxes are applied to goods unless exempted while services are exempted unless specifically included by the tax code. Economists agree that there is no economic reason to treat goods and services differently. In fact, all products are a combination of a good and a service. Government purchases should also not be exempt because government often competes with private companies that must collect sales tax.

The accompanying chart shows the steady decline of the Georgia sales tax base over time as a percentage of personal income. Taxing most goods and services at the retail level would more than double Georgia’s sales tax base.[1]

Personal Income Tax Base: Exemptions include the standard deduction, itemized deductions, personal exemptions and retirement income of up to $130,000 per couple. Eliminating these exemptions would increase taxable income by approximately 40 percent.[2]

More than half of all business income nationally is taxed through the individual income tax, not the corporate income tax. That’s because more than nine out of 10 businesses are organized as “pass-throughs” – Partnerships, Sole Proprietorships or S Corporations. That amounts to more than 800,000 small businesses in Georgia.

The nearby table, based on a study by Georgia State University, demonstrates how broadening the sales tax base to include groceries and services enhances growth and reduces volatility.[3]

Overview

An almost universally held principle of good tax reform is the goal of broadening the tax base and lowering tax rates. Economists also generally agree that taxing consumption is preferable to taxing income.

| Broadening Sales Tax Base Enhances Growth and Lowers Volatility | ||

| Growth | Volatility | |

| No Groceries or Services | 4.13 | 23.12 |

| Add Groceries | 4.05 | 15.78 |

| Add Services | 4.41 | 5.34 |

Small businesses, and start-up companies in particular, are critical to job growth. Without startups, there would be no net job growth in the U.S. economy, according to a study by the Kauffman Foundation. “From 1977 to 2005, existing companies were net job destroyers, losing 1 million net jobs per year. In contrast, new businesses in their first year added an average of 3 million jobs annually.”

Just as important are the entrepreneurs behind those start-up companies. Gallup CEO Jim Clifton has noted that the technology build-out that led to the $10 trillion of unplanned revenue growth over the last 25 years in the United States can be traced to about 1,000 innovators and entrepreneurs.[4]

Georgia has made strides in developing its start-up ecosystem over the last five years, but still loses too many young startups due to a lack of capital. How do you fix that? As former Citicorp CEO famously noted, “Capital goes where it’s welcome and stays where it’s well treated.”

|

28 States with Personal Income Tax Rates Lower Than Georgia |

| Alaska – 0% Florida – 0% Nevada – 0% New Hampshire – 0%* South Dakota – 0% Tennessee – 0%* Texas – 0% Washington – 0% Wyoming – 0% Pennsylvania – 3.07% North Dakota – 3.22% Indiana – 3.3% Illinois – 3.75% Michigan – 4.25% Arizona – 4.54% Kansas – 4.6% Colorado – 4.63% New Mexico – 4.9% Alabama – 5% Mississippi – 5% Utah – 5% Massachusetts – 5.15% Oklahoma – 5.25% Ohio – 5.33% North Carolina – 5.499%** Maryland – 5.75% Virginia – 5.75 Rhode Island – 5.99% Georgia – 6% Kentucky – 6% Louisiana – 6% Missouri – 6% |

| * NH and TN currently tax interest and dividends only (not wages). TN passed legislation in 2016 to completely phase out the personal income tax.

** NC rate effective 2017 |

When entrepreneurs choose to move to Florida, for example, to escape Georgia’s 6 percent income tax, Georgia doesn’t just lose the tax revenue on the sale of the entrepreneur’s business and the tax on his or her earnings. Also lost is their community leadership, their philanthropic giving and the mentoring and investment in the next generation of entrepreneurs.

For business owners, states like Florida and Texas (no tax) are just an airport away. Tennessee (6 percent on dividends and interest income) and North Carolina (5.75 percent income tax and dropping) are a short drive away. It’s easy for the wealthy and retirees to relocate their homes and wealth beyond Georgia’s tax reach. Further, Georgia’s rate reduces its regional competitiveness, leading the state to offer more tax incentives to lure new business.

Second, taxing individuals’ income stifles job creation, because the majority of business income is taxed through the individual income tax.

More important, taxing what individuals earn is a huge disincentive to productivity, business expansion and job creation. Taxing individuals’ income unfairly penalizes people who save more, work more and earn more.

In reality, the income tax is not a tax on the wealthy; it’s a tax on becoming wealthy. The wealthy can hire professional advisors to help them find loopholes and tax shelters. They can purchase non-taxable investments, time their income streams or just spend six months of the year in Florida. It’s the working class that gets stuck paying the bulk of income taxes, which limits their ability to accumulate wealth.

Georgia could use a boost to its economy. According to a study by the Federal Reserve Bank of Atlanta, “If long-term growth rates seem too low relative to other states, lowering aggregate state and local marginal tax rates is likely to have a positive effect on long-term growth rates.” This is exactly the problem facing Georgia.

As measured by gross state product, the state’s economy has grown more slowly from 2002 to 2012 than all but eight states. Tax reform is not the threat to Georgia’s future. Maintaining the status quo is.

Recommendation: Broaden the base of the income and sales tax and reduce tax rates

The method of accomplishing this goal is more of a political decision than a policy issue.

Benefits:

- Simple: Fewer deductions and exemptions would improve administration and compliance.

- Pro-growth: Taxes on work, savings and investment could be dramatically reduced, resulting in more jobs and higher disposable income for families.

- Competitive: Lower tax rates would give Georgia a competitive advantage.

- Stable: A broader tax base will be more stable during recessions, reducing the need for emergency spending cuts, and the tax base will grow more quickly, allowing the state to fully fund core government programs.

- Fair: Low-income families will face better job opportunities in a growing economy and all products will be taxed at the same low rate. A refundable tax credit could be created to offset significant tax increases on low-income families.

Several options have been studied.

The Special Council on Tax Reform and Fairness for Georgians recommended eliminating most of the current exemptions in the individual income tax code.[5] Another proposal would limit itemized deductions to charitable contributions and up to $20,000 of mortgage interest. This would allow the top personal income tax rate to be reduced to 5.25 percent.[6]

On the sales tax side, the Council recommended expanding the sales tax base to groceries and services that are already taxed in a large number of states. (Gov. Zell Miller phased out the state sales tax on groceries in the 1990s, but local sales taxes were not removed.)

The FairTax is a retail sales tax applied to nearly all goods and services. In studies prepared for the Georgia Senate Fair Tax Study Committee, the Fiscal Research Center at Georgia State University estimated that eliminating the personal and corporate income tax and incorporating a state FairTax with a rate of 6.42 percent would result in no loss of income to the state and would lower the tax burden for most low-income families.[7] A more recent study by the Beacon Hill Institute found a FairTax rate of 5.4 percent would be sufficient.[8] Georgia’s current sales tax rate is 4 percent and local sales taxes add an additional 2-4 percent. With the additional local revenue from a FairTax, local sales tax rates and/or property taxes could be reduced.

[1] Fiscal Research Center, Georgia State University, reports prepared for the Georgia Senate Fair Tax Study Committee, September – November 2013, “Analysis of Alternative Consumption Tax Structures for Georgia,” September 2013, http://cslf.gsu.edu/files/2014/06/analysis_of_alternative_consumption_tax_structures_for_georgia.pdf

[2] Georgia Tax Expenditure Report, 2014, http://www.open.georgia.gov/rsa/taxrpt/viewMain.aud

[3] “Georgia’s Tax Portfolio: Present and Future,” Ray D. Nelson, Georgia State University Fiscal Research Center, September 2012, http://frc.gsu.edu/sites/default/files/documents/Rpt%20247FIN%281%29.pdf

[4] “Global Migration Patterns and Job Creation,” Jim Clifton, Chairman and CEO of Gallup, 2007, http://bit.ly/1NzTmab

[5] http://www.terry.uga.edu/media/documents/selig/georgia-tax-reform.pdf

[6] Policy Memorandum, Fiscal Research Center, Georgia State University, November 2013, page 5, http://bit.ly/1qXh4IM

[7] Ibid.

[8] The Beacon Hill Institute for Public Policy Research. “A State FairTax for Georgia,” August 2015, https://www.gafairtax.org/wp-content/uploads/2015/04/Beacon-Hill-Rate-Study-2015-08.pdf