With only five legislative days remaining in the 2024 General Assembly, how are things looking for the effort to reduce Certificate of Need (CON) laws in Georgia?

Repealing CON laws, in which the government is allowed to determine whether new healthcare facilities or service lines are allowed to open, remains one of the more contentious political debates. Pairing this discussion in recent months with the potential of Medicaid expansion has done little to lessen the intensity.

Incumbent providers in any business sector typically fight like hell to maintain the status quo. It just so happens that most corporations with hundreds of millions of dollars in annual profit are not government protected monopolies. Nor do most oil companies or tech giants – to borrow favored boogeymen of both the left and right – enjoy non-profit status, or possess financially struggling independent operators they can put forth in a political debate.

Last year, the Foundation shared the story of Katie Chubb, who tried to open the Augusta Birth Center in 2021, but has been unable to receive a Certificate of Need three years after she submitted an 821-page application.

We hope you will check out this week’s commentary on where CON reform stands after both the House and Senate introduced bills to reduce the burden of CON laws by varying degrees. You’ll also find the latest news and analysis from the last week, including:

- Georgia House passes school choice expansion that would create state’s first education savings account program

- Measures to lower income taxes advance

- Inflation came in hotter than expected in February

- The latest stories of waste, fraud and abuse in Georgia

– Kyle Wingfield

Friday’s Freshest

House adopts Georgia Promise Scholarship Act

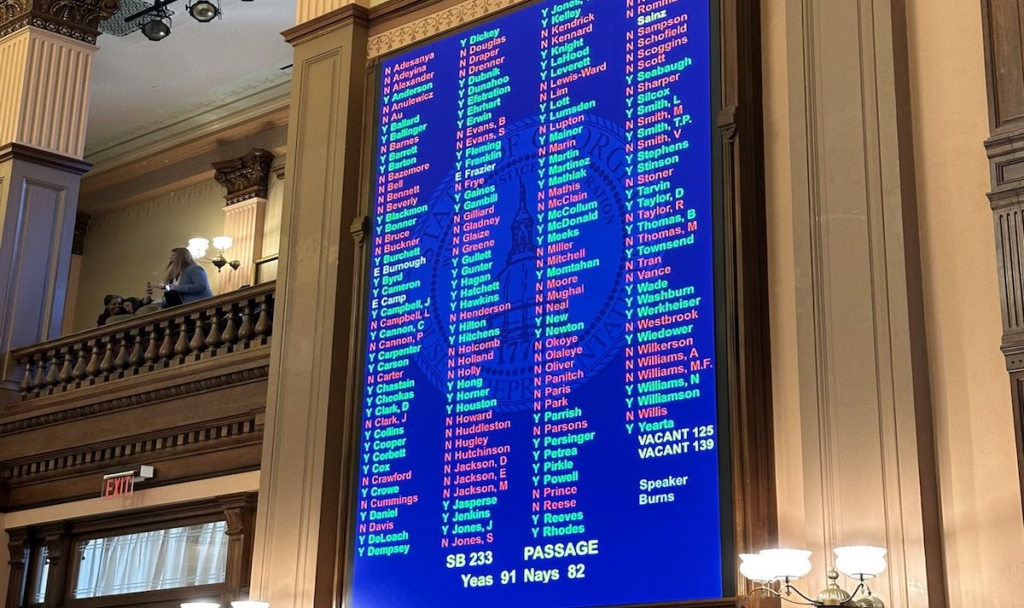

The Georgia House took a crucial step toward creating the state’s first education scholarship account (ESA) program by approving Senate Bill 233 on Thursday.

The vote to create Promise Scholarship accounts was 91-82, the minimum number of “yes” votes required for approval. It came almost one year after the House rejected the bill by six votes; a motion to reconsider kept it alive for 2024.

📢 Foundation releases statement on passage of Promise Scholarships

The conditions are right for serious tax reform

Some ways lawmakers can be aggressive on tax reform are featured in a new study the Georgia Public Policy Foundation co-published with the Buckeye Institute. That study, “Next Steps for Georgia Tax Reform,” outlined four different scenarios lawmakers could pursue. And with an $11 billion surplus and our neighboring states rapidly cutting their tax rates, we risk falling behind if we don’t take action.

Lawmakers avoid making long-term obligations with temporary surpluses

Add it all up, and more than $4.1 billion in new spending can easily be attributed to one-time capital expenditures. And it’s being funded with surplus cash, rather than borrowed money via revenue bonds, so future taxpayers won’t be repaying this money.

Officials at yet another school district in Georgia can’t do basic arithmetic

The Hancock County Board of Education accepted federal dollars as part of the Child Nutrition Cluster program and used it to pay the School Food Service director’s salary. But school district officials made a costly mistake, to the tune of more than $40,000, according to a report the Georgia Department of Audits and Accounts published last month. That story, and more, in our monthly recap of waste, fraud and abuse in Georgia.

Gwinnett County offers latest transportation tax plan

Following continued opposition from voters, Gwinnett County leaders jettisoned MARTA and rail. Most parts of Gwinnett don’t have the population or employment density for rail. In its place Gwinnett chose two types of Bus Rapid Transit. What will that mean for Gwinnett County residents?

At the Capitol: Week of March 11

The 2024 session continues to tick by as lawmakers completed Legislative Day 35 on Thursday. With Sine Die staring lawmakers down, there are only a handful of days remaining on the calendar to finish business. Here’s a recap of what happened last week:

- A bill to lower the income tax rate from 5.49% to 5.39% cleared the Senate Finance Committee this week. HB 1015 is sponsored by Rep. Lauren McDonald, R-Cumming.

- Similarly, HB 1023, sponsored by Rep. Bruce Williamson, R-Monroe, matches the corporate income tax rate to the individual income tax rate. It also advanced from Senate Finance.

- The House passed the Georgia Promise Scholarship Act Thursday after it fell short last year. SB 233, authored by Sen. Greg Dolezal, R-Cumming, would create state funded education scholarship accounts that families could use for private school and other educational expenses.

- After overwhelmingly passing the House, HB 1339, authored by Rep. Butch Parrish, R-Swainsboro, passed the Senate on Thursday by a vote of 43-11. This bill seeks to modernize CON laws and ease processes for hospitals.

- Legislation legalizing sports betting in Georgia that the state Senate passed last month got its first hearing this week in the state House. SB 386, authored by Sen. Clint Dixon, R-Buford, would allow the Georgia Lottery Corp. to oversee sports betting, awarding licenses to 16 sports betting providers.

- The Georgia House of Representatives passed legislation aimed at “swatting,” which means falsely reporting criminal activity that sends police to the homes or offices of targeted victims. SB 421 is also sponsored by Sen. Dixon.

- Gov. Brian Kemp signed a measure allowing the new Prosecuting Attorneys Qualifications Commission to start its work. SB 332, authored by Sen. Randy Robertson, R-Cataula, allows the commission that was created last year to adopt internal guidelines and rules.

The Latest

Economy

Tax reform will boost Georgia’s economy, study shows

Piles of academic studies show that tax policy impacts where people choose to live. In general, states with lower tax rates attract more businesses and residents. A new study from the Buckeye Institute’s Economic Research Center and the Georgia Public Policy Foundation shows that Georgia can reform its tax code to better compete with its low-tax neighbors and boost economic growth.

Inflation ran hotter than expected in February as high prices persist

Inflation unexpectedly ticked higher in February thanks to a jump in the cost of gasoline and rent, underscoring the challenge of taming price pressures within the economy. The Labor Department said that the consumer price index rose 0.4% in February from the previous month and 3.2% from the same time last year.

Georgia’s net tax collections decreased in February

Georgia’s February net tax collections decreased by 4.3% or $92.3 million from a year ago, but year-to-date collections remain above last year thanks to the state reinstating the gas tax. Monthly collections totaled more than $2 billion, and year-to-date net tax revenue surpassed $21.1 billion, a 1.1% or $223.4 million increase from fiscal 2023.

Georgia unemployment rate drops for first time in more than a year

State officials announced Georgia’s unemployment rate has dropped for the first time in more than a year. Georgia Labor Commissioner Bruce Thompson reported the unemployment rate declined from 3.2% to 3.1% from December to January, the first month-to-month drop after holding at 3.2% for each month during 2023. The number of employed individuals was also up by 4,814, making the total an all-high of 5,163,147, according to the state.

Education

Rural Republicans embrace school choice

Wyoming and Alabama are two of the latest states to advance legislation that allows families to take their children’s state-funded education dollars to the public, private, charter or home-based providers of their choosing. What are we seeing? Despite the long held belief by many that rural residents don’t want or couldn’t use school choice, the nine most rural states in the country (as measured by population share) now have some form of private school choice.

Savannah public schools attendance rate at 75%

Savannah-Chatham County Public School System students’ average daily attendance rate for the first half of the 2023-24 academic year was about 75%, according to recent reporting provided by the district’s Data and Accountability Division. This means that districtwide, around 25% of students enrolled missed nine or more school days within the first 90 days.

Augusta school board hears community input on rightsizing plan

The Richmond County School System played host to several community input meetings regarding their tentative Facilities Masters Plan, which would close multiple schools, open others and move many students around over the next few years to better utilize resources and secure more state funding.

Families embrace Georgia’s shift to small, inclusive schools

In the ever-evolving educational landscape of Georgia, a quiet but powerful transformation is taking place. Microschooling, an increasingly popular model of nontraditional education, is sweeping the Peach State, presenting parents with a beacon of hope and innovation. Microschools are small by design, with the goal of providing a more personalized, flexible, and community-centric approach to learning.

Government accountability

Cobb County eyes changes to public comments

The future is uncertain for proposed changes to county commission meeting rules, including adding the number of people who can give public comment and reducing the number of proclamations and resolutions commissioners can present at each meeting.

Roswell City Council approves tighter regulations on massage and spa establishments

Updates to massage and spa establishment ordinances in Roswell were approved at a city council meeting on Monday night. For months, Mayor Kurt Wilson said the city worked on the amendments alongside licensed massage therapists to ensure the changes wouldn’t hurt businesses but add protections.

Bulloch County: Even a $110M SPLOST won’t pay for all buildings on the want list

During the first day of the Bulloch County government’s two-day goal-setting retreat toward the fiscal year 2025 budget, County Manager Tom Couch spoke on planning toward a six-year extension of the Special Purpose Local Option Sales Tax and observed that it can’t pay for everything everybody has suggested, even with a “robust economy.”

Transportation

Seven automakers join to create Ionna, a massive new EV charging network

BMW, GM, Honda, Hyundai, Kia, Mercedes, and Stellantis have joined forces to develop a U.S. electric vehicle charging network called Ionna, based on an existing network in Europe called Ionity. The plan is to have 30,000 charging stations installed and operating by 2030.

The questionable future of the Highway Trust Fund

Due to both recent changes in federal fuel-economy mandates for new vehicles and increased subsidies for electric vehicles, gas-tax revenue is shrinking at an ever-faster rate. Federal gas tax receipts are now projected to decline from $24 billion this year to less than $18 billion in Fiscal Year 2034.

Floyd County gets $3.8 million for airport runway extension

U.S. Rep. Marjorie Taylor Greene (R-GA-14) announced she has secured just over $3.8 million in federal funding for the runway extension at the Richard B. Russell Regional Airport in Floyd County. In February, the county commission awarded a $6.9 million contract to Bartow Paving Co. for the bulk of the remaining work. The new award will offset the $2.4 million budget increase the contract required.

Bonus

The boomers who tried moving to Florida and ended up in Appalachia

Dawson County is changing in ways big and small, as baby boomers known as “halfbacks” transform southern Appalachia—the moniker a reference to how many first moved from the Northeast and Midwest down to Florida before settling somewhere in between. The influx of retirees flooding into southern Appalachia is transforming the region from poor, serene and rustic to a bustling retirement haven.

Nearly 1,000 Family Dollar stores to close

Dollar Tree announced this week that it plans to close nearly 1,000 U.S. stores in its portfolio after suffering a significant quarterly loss. As part of its portfolio optimization, the company will close 600 of its Family Dollar stores in the first half of 2024. An additional 370 Family Dollar stores and 30 Dollar Tree stores will close over the next several years once their leases expire.

Alpharetta joins conversation about NHL returning to Metro Atlanta

Nearly 13 years after the NHL left Atlanta, there is significant movement towards bringing hockey back to the city. The Alpharetta Sports & Entertainment Group, fronted by former NHL player Anson Carter, has formally requested the NHL commence with an expansion process aimed at bringing a franchise to the area for a third time.

Quotes of the Week

“Home is the place where, when you go there, they have to take you in.” – Robert Frost

“Peace is not the absence of conflict, it is the presence of justice.” – William Faulkner

“Victorious warriors win first and then go into war, while defeated warriors go to war first and then seek to win.” – Sun Tzu