Georgia’s tuition tax credit scholarship doesn’t harm public school systems financially.

Ever since school choice programs have existed, opponents have argued these programs do financial harm to tradational public schools.

Our Senior Fellow, Dr. Ben Scafidi, published a study for the Friedman Foundation to address the following question: “If a significant number of students left a public school district for any reason from one year to the next, then is it feasible for the district to reduce some of its expenditures commensurate with the decrease in its student population?”

According to Scafidi: “The answer that comes from analyzing the finances of large and small school districts that lost students is ‘yes.’ Both the large school districts and the small ones were able to reduce the combination of instructional and support expenses at a higher rate than the losses in students. Thus, these costs were variable, even in the short-run.”

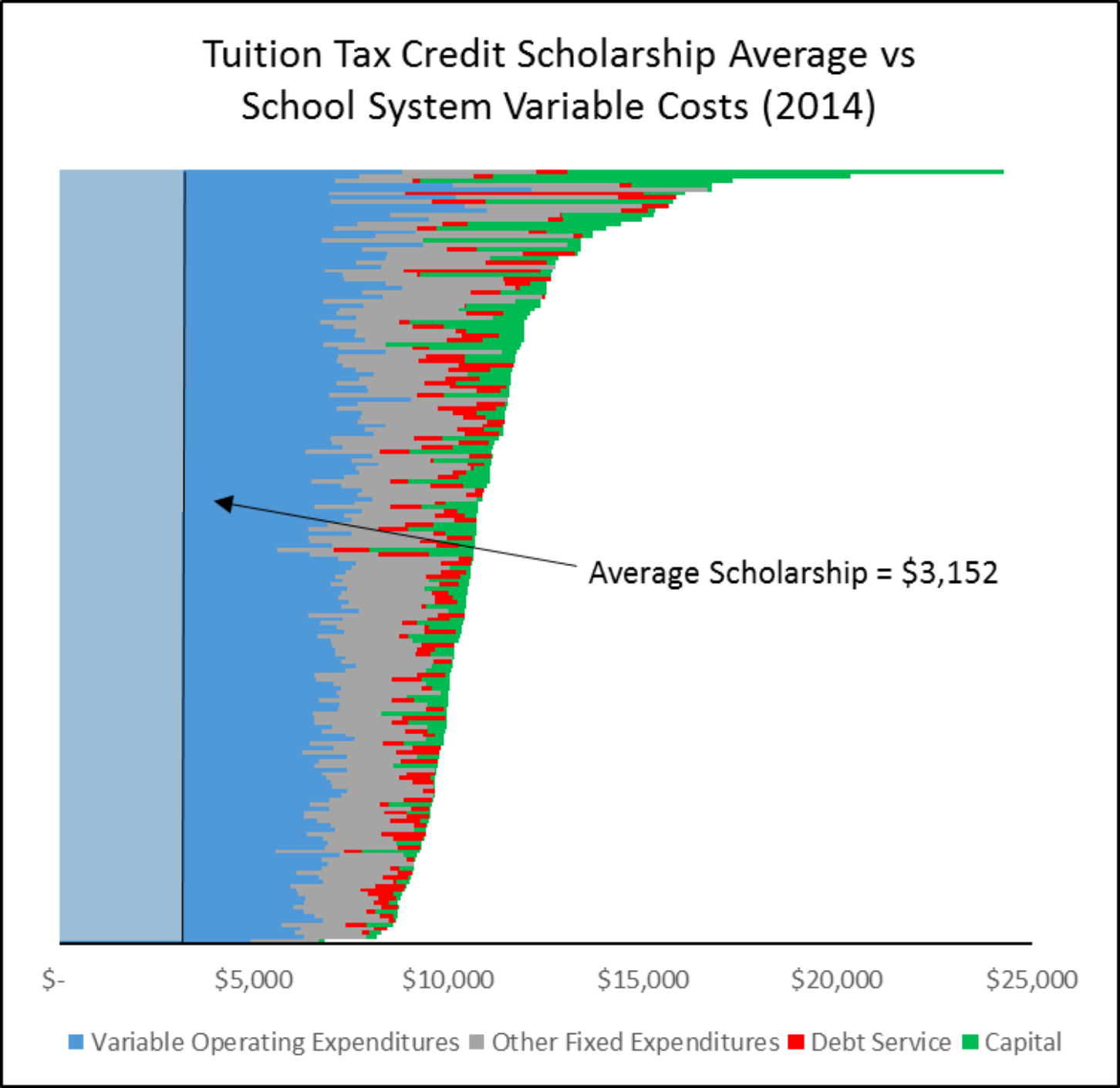

The chart below represents the total expenditures of every school system in Georgia stacked on top of each other. The expenditures are color coded, based on the Dr. Scafidi’s research, into variable and fixed costs. The variable costs are color coded blue, while fixed costs are green (capital spending), red (debt service) and gray (other fixed expenditures). Finally, we have highlighted the first $3,152 of spending in each district. This represents the average amount of scholarships awarded by Georgia’s tuition tax credit scholarship program. As you can see, the average amount of the scholarship does not exceed variable costs in any of Georgia’s school systems.

This is exactly what Dr. Scafidi argues here.

Interested in the details for your school system? Go to this site and select the tab at the top labeled “Fixed and Variable Exp.”

Ever since school choice programs have existed, opponents have argued these programs do financial harm to tradational public schools.

Our Senior Fellow, Dr. Ben Scafidi, published a study for the Friedman Foundation to address the following question: “If a significant number of students left a public school district for any reason from one year to the next, then is it feasible for the district to reduce some of its expenditures commensurate with the decrease in its student population?”

According to Scafidi: “The answer that comes from analyzing the finances of large and small school districts that lost students is ‘yes.’ Both the large school districts and the small ones were able to reduce the combination of instructional and support expenses at a higher rate than the losses in students. Thus, these costs were variable, even in the short-run.”

The chart below represents the total expenditures of every school system in Georgia stacked on top of each other. The expenditures are color coded, based on the Dr. Scafidi’s research, into variable and fixed costs. The variable costs are color coded blue, while fixed costs are green (capital spending), red (debt service) and gray (other fixed expenditures). Finally, we have highlighted the first $3,152 of spending in each district. This represents the average amount of scholarships awarded by Georgia’s tuition tax credit scholarship program. As you can see, the average amount of the scholarship does not exceed variable costs in any of Georgia’s school systems.

This is exactly what Dr. Scafidi argues here.

Interested in the details for your school system? Go to this site and select the tab at the top labeled “Fixed and Variable Exp.”