By Kelly McCutchen

Addressing pre-existing issues and helping low-income individuals afford health insurance are two major issues being debated in health care reform. The challenge is avoiding unintended consequences by making sure the right incentives are in place.

Insurance Regulations

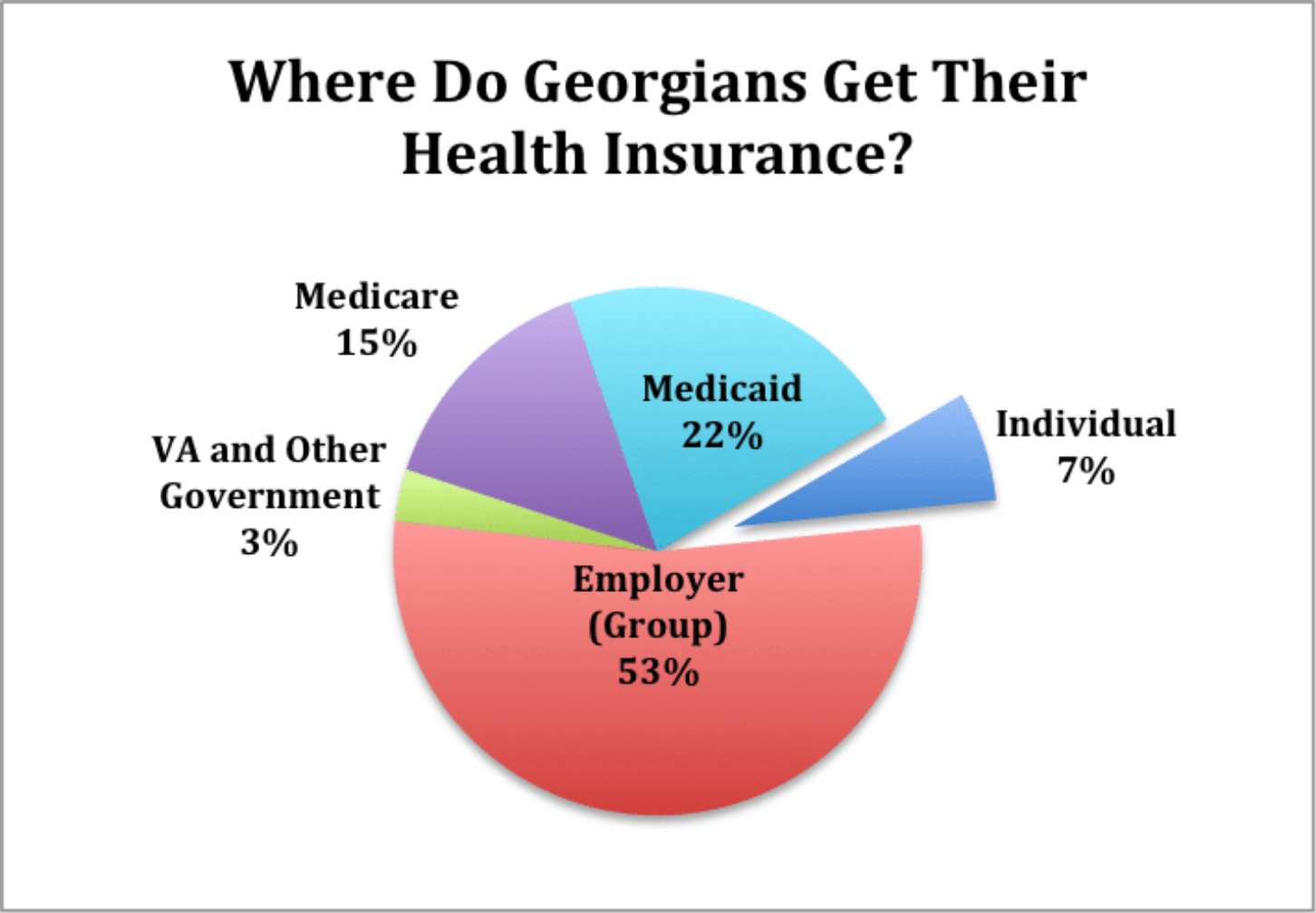

Before the Affordable Care Act (ACA), states regulated individual and small group insurance. The ACA preempted state regulations and imposed a host of new federal requirements. These regulations primarily impacted the individual insurance market, where only seven percent of Georgians get their health insurance. These new regulations included:

Guaranteed Issue: Even though insurance is based on the concept of providing financial protection for “unforeseeable” future events, this regulation forced insurance to cover pre-existing condition.

Community Rating: This regulation prohibited insurers from using health status to price premiums. Premiums are only allowed to vary by age and geography, creating an incentive to game the system by focusing on attracting healthy customers and avoiding the sick.

Age Rating: This regulation further restricted the pricing of premiums by limiting the difference between premiums for the youngest and oldest to a factor of 3:1 instead of the normal variance in health care costs, which is closer to a 5:1 ratio.

The age rating regulations significantly increased premiums for young people, causing many to forego insurance. Thanks to the guaranteed issue and community rating regulations, there was little risk in waiting to buy health insurance until they were sick since they could not be denied and could not be charged a higher price.

Over time, the individual market has become older, sicker and more expensive. Average health insurance premiums in Georgia have more than doubled in the last four years, from $2,508 to $5,172. Insurance companies have either pulled out of the market or dramatically narrowed the choice of providers in their networks. The least healthy individuals who needed the coverage had to pay the rising prices, but struggled to find access to the care they needed in their network.

Risk Pools

While helping people with pre-existing conditions is something the public supports, doing it through insurance regulation in the individual market is not the way to do it. The problem with this system is it forces a relatively few Georgians who don’t have access to insurance at work to pay for the very sick. As Senator Ted Cruz said recently, “It’s not fair to a working-class person who’s struggling to put food on the table, for the federal government to double their premiums trying to work an indirect subsidy for others who are ill. Far better to have it through direct tax revenue.”

In the U.S. House of Representatives health care proposal, direct tax revenue was provided to create an Invisible Risk-Sharing Pool, a way of subsidizing high-cost individuals with tax dollars instead of forcing everyone in the indivdual market to pay higher premiums. In addition, the age-rating regulation reverted back to a 5:1 ratio. Milliman, a respected actuarial firm, projected the impact of these two proposals on premiums which are shown in the chart below. The study projects that average premiums would go down by as much as 31 percent, with premiums for young people decreasing as much as 43 percent.

Tax Credits

One of the problems with the House health care bill was the tax credits designed to help middle- and low-income individuals afford insurance were $2,000 to $4,000, depending on age. This was a problem because the tax credits for older individuals were only twice as large as those for young people, while their premiums were five times higher.

Under the Senate proposal, the tax credits are closer to a 5:1 ratio. In Rome, Georgia, for example, the tax credit for a 27-year-old with income of $30,000 is $2,200 and the credit for a similar 60-year-old is $10,700. (Source: Kaiser Family Foundation)

If you compare these tax credits to the projected premiums in the chart, you can see they match fairly closely.

The credits are flexible enough to adjust to the most expensive areas of southwest and south Georgia where hospital monopolies and sicker populations have raised premiums to some of the highest in the nation.

By Kelly McCutchen

Addressing pre-existing issues and helping low-income individuals afford health insurance are two major issues being debated in health care reform. The challenge is avoiding unintended consequences by making sure the right incentives are in place.

Insurance Regulations

Before the Affordable Care Act (ACA), states regulated individual and small group insurance. The ACA preempted state regulations and imposed a host of new federal requirements. These regulations primarily impacted the individual insurance market, where only seven percent of Georgians get their health insurance. These new regulations included:

Guaranteed Issue: Even though insurance is based on the concept of providing financial protection for “unforeseeable” future events, this regulation forced insurance to cover pre-existing condition.

Community Rating: This regulation prohibited insurers from using health status to price premiums. Premiums are only allowed to vary by age and geography, creating an incentive to game the system by focusing on attracting healthy customers and avoiding the sick.

Age Rating: This regulation further restricted the pricing of premiums by limiting the difference between premiums for the youngest and oldest to a factor of 3:1 instead of the normal variance in health care costs, which is closer to a 5:1 ratio.

The age rating regulations significantly increased premiums for young people, causing many to forego insurance. Thanks to the guaranteed issue and community rating regulations, there was little risk in waiting to buy health insurance until they were sick since they could not be denied and could not be charged a higher price.

Over time, the individual market has become older, sicker and more expensive. Average health insurance premiums in Georgia have more than doubled in the last four years, from $2,508 to $5,172. Insurance companies have either pulled out of the market or dramatically narrowed the choice of providers in their networks. The least healthy individuals who needed the coverage had to pay the rising prices, but struggled to find access to the care they needed in their network.

Risk Pools

While helping people with pre-existing conditions is something the public supports, doing it through insurance regulation in the individual market is not the way to do it. The problem with this system is it forces a relatively few Georgians who don’t have access to insurance at work to pay for the very sick. As Senator Ted Cruz said recently, “It’s not fair to a working-class person who’s struggling to put food on the table, for the federal government to double their premiums trying to work an indirect subsidy for others who are ill. Far better to have it through direct tax revenue.”

In the U.S. House of Representatives health care proposal, direct tax revenue was provided to create an Invisible Risk-Sharing Pool, a way of subsidizing high-cost individuals with tax dollars instead of forcing everyone in the indivdual market to pay higher premiums. In addition, the age-rating regulation reverted back to a 5:1 ratio. Milliman, a respected actuarial firm, projected the impact of these two proposals on premiums which are shown in the chart below. The study projects that average premiums would go down by as much as 31 percent, with premiums for young people decreasing as much as 43 percent.

Tax Credits

One of the problems with the House health care bill was the tax credits designed to help middle- and low-income individuals afford insurance were $2,000 to $4,000, depending on age. This was a problem because the tax credits for older individuals were only twice as large as those for young people, while their premiums were five times higher.

Under the Senate proposal, the tax credits are closer to a 5:1 ratio. In Rome, Georgia, for example, the tax credit for a 27-year-old with income of $30,000 is $2,200 and the credit for a similar 60-year-old is $10,700. (Source: Kaiser Family Foundation)

If you compare these tax credits to the projected premiums in the chart, you can see they match fairly closely.

The credits are flexible enough to adjust to the most expensive areas of southwest and south Georgia where hospital monopolies and sicker populations have raised premiums to some of the highest in the nation.

Kelly McCutchen is president of the Georgia Public Policy Foundation.