Most experts agree that recent federal tax reforms will put pressure on high tax states to either reduce taxes or continue to lose residents fleeing to lower tax states.

The recently passed federal tax reform places a $10,000 cap on the deduction of state and local taxes for taxpayers who itemize their deductions. For many other taxpayers, the large increase in the standard deduction means they will no longer itemize, and therefore cannot deduct the cost of their local taxes.

Most experts agree this will put pressure on high tax states to either reduce taxes or continue to lose residents fleeing to lower tax states.

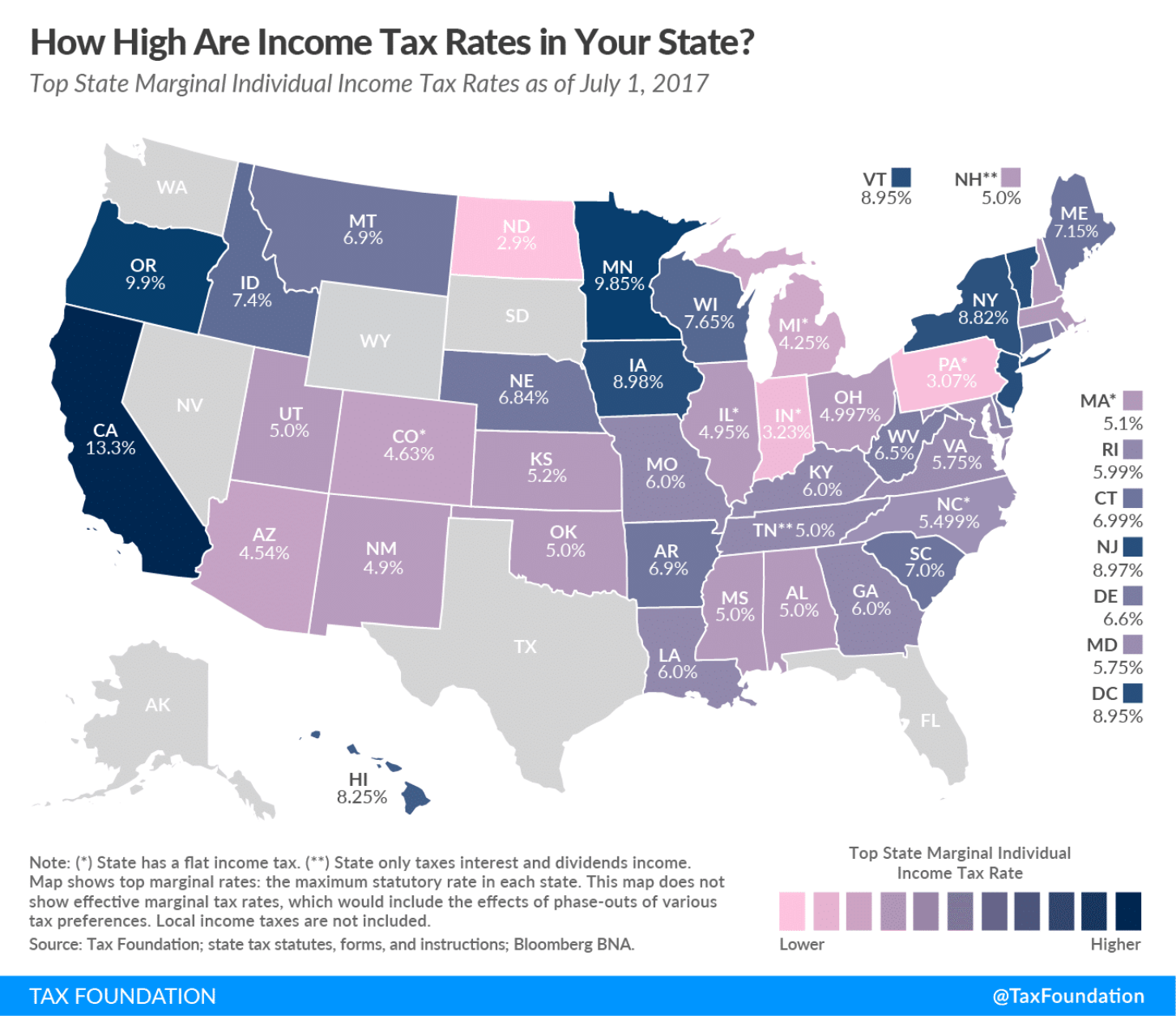

This map of state income tax rates from the Tax Foundation shows Georgia’s income tax rate it high relative to most of its neighbors, especially since Tennessee just voted to phase out its income tax entirely, joining Florida, Texas, Nevada, Washington, South Dakota, Wyoming and Alaska.

Even a small reduction in the income tax from 6 percent to 4.9 percent would move Georgia’s rate below many competing states. Fortunately, based on the federal tax law changes Georgia should experience a windfall in state income tax windfall that can be used to lower its tax rate.

But just as the changes to the tax law incentivize residents to move from high tax to low tax states, the incentives are just the same within each state’s boundaries. In an effort to make rural Georgia more desirable to residents in Georgia’s cities, lawmakers have proposed tax reductions for new residents in rural Georgia. By making it more expensive to live in high tax areas of the state, the federal law has already created the incentive without the need for state legislation.

Below is a sampling of tax rates in metro Atlanta. These 30 metro Atlanta counties represent 56 percent of the state’s population. Shown in the table are the lowest and highest property tax rates for jurisdictions in each county, the sales tax rate and the median home price in each county based on recent sales. (The millage rates includes levies for county and/or municipal government, schools and other local services. The City of Atlanta is broken out because it has a different sales tax rate.)

More affordable housing costs can offset higher millage rates, which should be encouraging to middle and South Georgia counties because most of the lowest property tax rates are found in north Georgia counties. For example, the only millage rates below 20 mills are found in the following jurisdictions: Fannin County Unincorporated (19.21), Hart County Unincorporated (19.40), Rabun County Unincorporated (17.39), the cities of Dillard, Mountain City and Tiger in Rabun County (17.79 each), Union County Unincorporated (17.36) and the City of Blairsville in Union County (19.36).

With the sales tax, three northern suburban Metro Atlanta counties — Cherokee, Cobb and Gwinnett — are the only counties in Georgia with the lowest sales tax rate of 6 percent. The City of Atlanta’s sales tax rate of 8.9 percent is the highest in the state. Every jurisdiction in rural Georgia levies either a 7 or 8 percent sales tax.

So while the federal tax law changes will bring Georgia new state revenue to lower its income tax rate and greatly enhance its economic competitiveness, local governments in rural Georgia also have a great opportunity to try to attract individuals and businesses currently located in high tax states and high tax areas of Georgia.

| County | Lowest Millage Rate | Highest Millage Rate | Sales Tax Rate | Median Home Sales Price |

| Barrow | 31.91 | 37.84 | 7 | $161,000 |

| Bartow | 27.73 | 32.66 | 7 | $155,767 |

| Butts | 33.31 | 33.31 | 7 | $117,995 |

| Carroll | 28.15 | 36.81 | 7 | $134,000 |

| Cherokee | 27.82 | 37.35 | 6 | $240,000 |

| Clayton | 34.81 | 49.55 | 8 | $120,000 |

| Cobb | 26.90 | 39.46 | 6 | $256,077 |

| Coweta | 28.24 | 37.49 | 7 | $200,000 |

| Dawson | 25.53 | 25.53 | 7 | $222,500 |

| DeKalb | 43.23 | 73.71 | 7 | $250,000 |

| Douglas | 34.05 | 40.83 | 7 | $150,000 |

| Fayette | 31.05 | 33.94 | 7 | $278,000 |

| Forsyth | 26.52 | 26.52 | 7 | $329,000 |

| Fulton | 33.75 | 45.74 | 7.75 | $308,000 |

| City of Atlanta | 44.12 | 44.12 | 8.9 | $216,700 |

| Gwinnett | 26.54 | 41.29 | 6 | $217,000 |

| Hall | 23.23 | 33.03 | 7 | $198,000 |

| Haralson | 28.00 | 41.64 | 7 | $125,000 |

| Heard | 22.36 | 22.36 | 7 | $144,000 |

| Henry | 38.08 | 41.58 | 7 | $167,950 |

| Jasper | 35.44 | 42.35 | 7 | $139,000 |

| Lamar | 27.26 | 31.40 | 7 | $121,500 |

| Meriwether | 32.96 | 51.91 | 7 | $100,000 |

| Morgan | 27.84 | 34.42 | 7 | $250,000 |

| Newton | 36.03 | 55.43 | 7 | $135,000 |

| Paulding | 32.57 | 37.57 | 7 | $165,000 |

| Pickens | 22.94 | 27.63 | 7 | $197,500 |

| Pike | 29.26 | 37.26 | 7 | $164,950 |

| Rockdale | 47.16 | 61.01 | 7 | $144,250 |

| Spalding | 39.80 | 44.24 | 7 | $127,250 |

| Walton | 36.06 | 45.85 | 7 | $199,000 |

The recently passed federal tax reform places a $10,000 cap on the deduction of state and local taxes for taxpayers who itemize their deductions. For many other taxpayers, the large increase in the standard deduction means they will no longer itemize, and therefore cannot deduct the cost of their local taxes.

Most experts agree this will put pressure on high tax states to either reduce taxes or continue to lose residents fleeing to lower tax states.

This map of state income tax rates from the Tax Foundation shows Georgia’s income tax rate it high relative to most of its neighbors, especially since Tennessee just voted to phase out its income tax entirely, joining Florida, Texas, Nevada, Washington, South Dakota, Wyoming and Alaska.

Even a small reduction in the income tax from 6 percent to 4.9 percent would move Georgia’s rate below many competing states. Fortunately, based on the federal tax law changes Georgia should experience a windfall in state income tax windfall that can be used to lower its tax rate.

But just as the changes to the tax law incentivize residents to move from high tax to low tax states, the incentives are just the same within each state’s boundaries. In an effort to make rural Georgia more desirable to residents in Georgia’s cities, lawmakers have proposed tax reductions for new residents in rural Georgia. By making it more expensive to live in high tax areas of the state, the federal law has already created the incentive without the need for state legislation.

Below is a sampling of tax rates in metro Atlanta. These 30 metro Atlanta counties represent 56 percent of the state’s population. Shown in the table are the lowest and highest property tax rates for jurisdictions in each county, the sales tax rate and the median home price in each county based on recent sales. (The millage rates includes levies for county and/or municipal government, schools and other local services. The City of Atlanta is broken out because it has a different sales tax rate.)

More affordable housing costs can offset higher millage rates, which should be encouraging to middle and South Georgia counties because most of the lowest property tax rates are found in north Georgia counties. For example, the only millage rates below 20 mills are found in the following jurisdictions: Fannin County Unincorporated (19.21), Hart County Unincorporated (19.40), Rabun County Unincorporated (17.39), the cities of Dillard, Mountain City and Tiger in Rabun County (17.79 each), Union County Unincorporated (17.36) and the City of Blairsville in Union County (19.36).

With the sales tax, three northern suburban Metro Atlanta counties — Cherokee, Cobb and Gwinnett — are the only counties in Georgia with the lowest sales tax rate of 6 percent. The City of Atlanta’s sales tax rate of 8.9 percent is the highest in the state. Every jurisdiction in rural Georgia levies either a 7 or 8 percent sales tax.

So while the federal tax law changes will bring Georgia new state revenue to lower its income tax rate and greatly enhance its economic competitiveness, local governments in rural Georgia also have a great opportunity to try to attract individuals and businesses currently located in high tax states and high tax areas of Georgia.

| County | Lowest Millage Rate | Highest Millage Rate | Sales Tax Rate | Median Home Sales Price |

| Barrow | 31.91 | 37.84 | 7 | $161,000 |

| Bartow | 27.73 | 32.66 | 7 | $155,767 |

| Butts | 33.31 | 33.31 | 7 | $117,995 |

| Carroll | 28.15 | 36.81 | 7 | $134,000 |

| Cherokee | 27.82 | 37.35 | 6 | $240,000 |

| Clayton | 34.81 | 49.55 | 8 | $120,000 |

| Cobb | 26.90 | 39.46 | 6 | $256,077 |

| Coweta | 28.24 | 37.49 | 7 | $200,000 |

| Dawson | 25.53 | 25.53 | 7 | $222,500 |

| DeKalb | 43.23 | 73.71 | 7 | $250,000 |

| Douglas | 34.05 | 40.83 | 7 | $150,000 |

| Fayette | 31.05 | 33.94 | 7 | $278,000 |

| Forsyth | 26.52 | 26.52 | 7 | $329,000 |

| Fulton | 33.75 | 45.74 | 7.75 | $308,000 |

| City of Atlanta | 44.12 | 44.12 | 8.9 | $216,700 |

| Gwinnett | 26.54 | 41.29 | 6 | $217,000 |

| Hall | 23.23 | 33.03 | 7 | $198,000 |

| Haralson | 28.00 | 41.64 | 7 | $125,000 |

| Heard | 22.36 | 22.36 | 7 | $144,000 |

| Henry | 38.08 | 41.58 | 7 | $167,950 |

| Jasper | 35.44 | 42.35 | 7 | $139,000 |

| Lamar | 27.26 | 31.40 | 7 | $121,500 |

| Meriwether | 32.96 | 51.91 | 7 | $100,000 |

| Morgan | 27.84 | 34.42 | 7 | $250,000 |

| Newton | 36.03 | 55.43 | 7 | $135,000 |

| Paulding | 32.57 | 37.57 | 7 | $165,000 |

| Pickens | 22.94 | 27.63 | 7 | $197,500 |

| Pike | 29.26 | 37.26 | 7 | $164,950 |

| Rockdale | 47.16 | 61.01 | 7 | $144,250 |

| Spalding | 39.80 | 44.24 | 7 | $127,250 |

| Walton | 36.06 | 45.85 | 7 | $199,000 |