About Us

At the Georgia Public Policy Foundation, we believe all good public policy is based upon fact, an understanding of sound economic principles and the core principles of our free enterprise system: economic freedom, limited government, personal responsibility, individual initiative, respect for private property and the rule of law.

These principles have real-world impact

Since 1991, our mission has been to improve the lives of Georgians by promoting public policies that enhance economic opportunity and freedom: “Changing Georgia Policy, Changing Georgians’ Lives.”

We tackle the bread-and-butter issues Georgians face: education, health care, fiscal and regulatory issues, housing, transportation, and economic opportunity.

We focus on these economic issues because we envision a state where innovation, entrepreneurship and creativity thrive, and individuals flourish based upon strong property rights, free markets and equal opportunity for all. The commonsense ideas and policies we propose can take root to demonstrate how our free-enterprise system succeeds and provides economic opportunity and freedom for all Georgians.

Mission

Our mission is to improve the lives of Georgians through public policies that enhance economic opportunity and freedom.

Vision

Our vision is a state that welcomes free, open, and civil exchanges of ideas to foster an atmosphere of liberty and limited government.

Recent Successes

The Foundation was a leader in the development of sweeping criminal justice reforms passed in 2012 and thereafter. These reforms have since become a national model, with more than 20 states and the federal government following our lead.

Long a champion of education choice and charter school programs, the Foundation led the way for a STEM charter and tech high school in Atlanta. More recently, the Foundation pushed for increases to a highly popular state tax-credit scholarship program and building a consensus for education scholarship accounts, both of which expand educational options for students and families.

The Foundation pushed for the creation of a state transparency database and disclosure of in-depth system- and school-level spending, supported the City of Sandy Springs as it became one of the nation’s first “private cities” by outsourcing nearly all government functions, and continues to push for privatization of golf courses, water parks, hotels and conference centers, tourist attractions, prisons and many other government functions.

The Foundation has led the way on reforming Georgia’s Certificate of Need laws restricting competition for health care providers, endorsed efforts to free the state from federal regulations tied to Medicaid and the Affordable Care Act, and promoted the 2019 passage of Direct Primary Care.

The Foundation helped push for one of the nation’s toughest laws on eminent domain abuse, supported Telecommunications deregulation, pushed for the elimination of burdensome professional licensing restrictions and helped lead the way for converting state employees to a hybrid pension plan.

The Foundation has always supported lower, flatter and broader state income taxes to ensure economic competitiveness, as well as the elimination of estate and intangibles taxes. Recent efforts have focused on lower rates, ending exemptions and implementing a consumption tax upon goods and services.

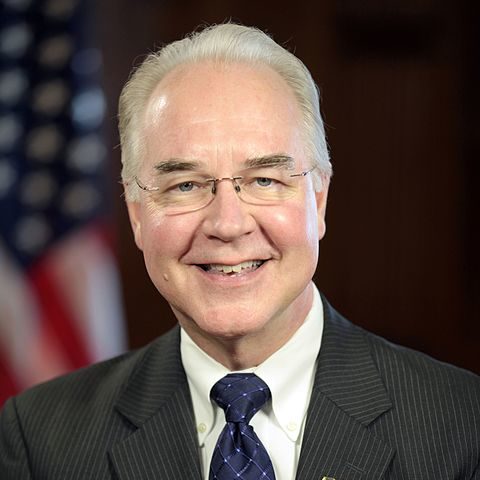

When I served four terms in the state Senate, one of the few places where you could go to always and get concrete information about real solutions was the Georgia Public Policy Foundation. That hasn’t changed. The Foundation is really right up there at the top of the state think tanks and should be very proud of the work they are doing!

Tom PriceFormer United States Congressman, Georgia

Tom PriceFormer United States Congressman, Georgia

The Foundation’s Criminal Justice Initiative pushed the problems to the forefront, proposed practical solutions, brought in leaders from other states to share examples, and created this nonpartisan opportunity.

Nathan DealFormer Governor, Georgia (At the 2012 Criminal Justice Reform Bill signing)

Nathan DealFormer Governor, Georgia (At the 2012 Criminal Justice Reform Bill signing)

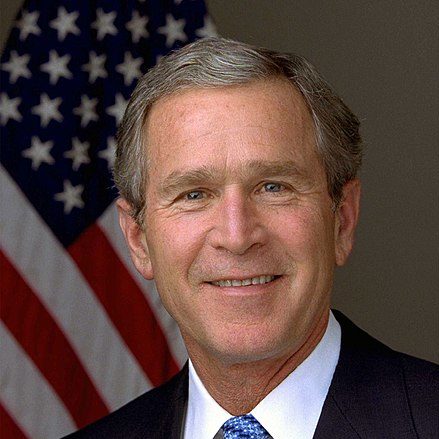

Thank you for what you do … researching and writing on issues that matter. You take on tough questions, you apply innovative thinking, you push for action, and you do it all without regard to politics.

George W. BushFormer President of the United States

George W. BushFormer President of the United States

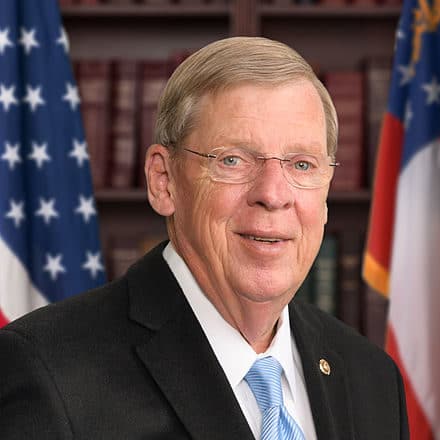

The Georgia Public Policy Foundation has forged over the years many positive changes in Georgia, in its nonpartisan but very specific way. The Foundation raises issues of importance above political rhetoric to a point where politicians focus on them and ultimately make quality decisions.

Johnny IsaksonFormer United States Senator, Georgia

Johnny IsaksonFormer United States Senator, Georgia