It’s Friday!

Events

The registration deadline is MONDAY for “Second Chances 2019,” an 8 a.m. Leadership Breakfast with Georgia Congressman Doug Collins, sponsor of the FIRST STEP Act, on Wednesday, April 17. This event marks Second Chance Month, an annual Prison Fellowship commemoration. Georgian Club. $30. Information and registration here.

May 23: “You Can Say That: How Courage Can Defeat Political Correctness,” a noon Policy Briefing Luncheon with David French of the National Review Institute, on Thursday, May 23. Georgian Club. $35. Information and registration here.

Quotes of note

“Small business in the United States is literally being suffocated by red tape. We like to think that we live in ‘the land of the free,’ but the truth is that our lives and our businesses are actually tightly constrained by millions of rules and regulations. Today there is a ‘license’ for just about every business activity. In fact, in some areas of the country today you need a ‘degree’ and multiple ‘licenses’ before you can even submit an application for permission to start certain businesses.” – Michael Snyder

“Since 1965, federal taxpayers have poured an estimated $2 trillion into education programs associated with President Lyndon Johnson’s War on Poverty. But despite this staggering expenditure – which represents just a fraction of combined federal, state and local K-12 spending – education attainment gaps between upper-income students and their less-affluent peers remain as wide as ever.” – Lindsey M. Burke, Mary Clare Amselem

“Many things that ought to be funded at a lower level of government wind up on the federal government’s tab – mostly because it’s the feds who are the ones waving the big checkbook around.” – Edwin J. Feulner

Myth: An NBC News/Wall Street Journal poll revealed that just 17 percent of Americans think their taxes will go down as a result of the 2017 Republican tax cut. Some 28 percent don’t know, while 27 percent say their taxes will stay the same, and a mind-numbing 28 percent think their taxes will go up.

Fact: Despite what many Americans believe about their taxes, for 2019, 48 percent of households are getting a tax cut greater than $500. Just 5.5 percent of households face tax increases greater than $100. Source: Wall Street Journal

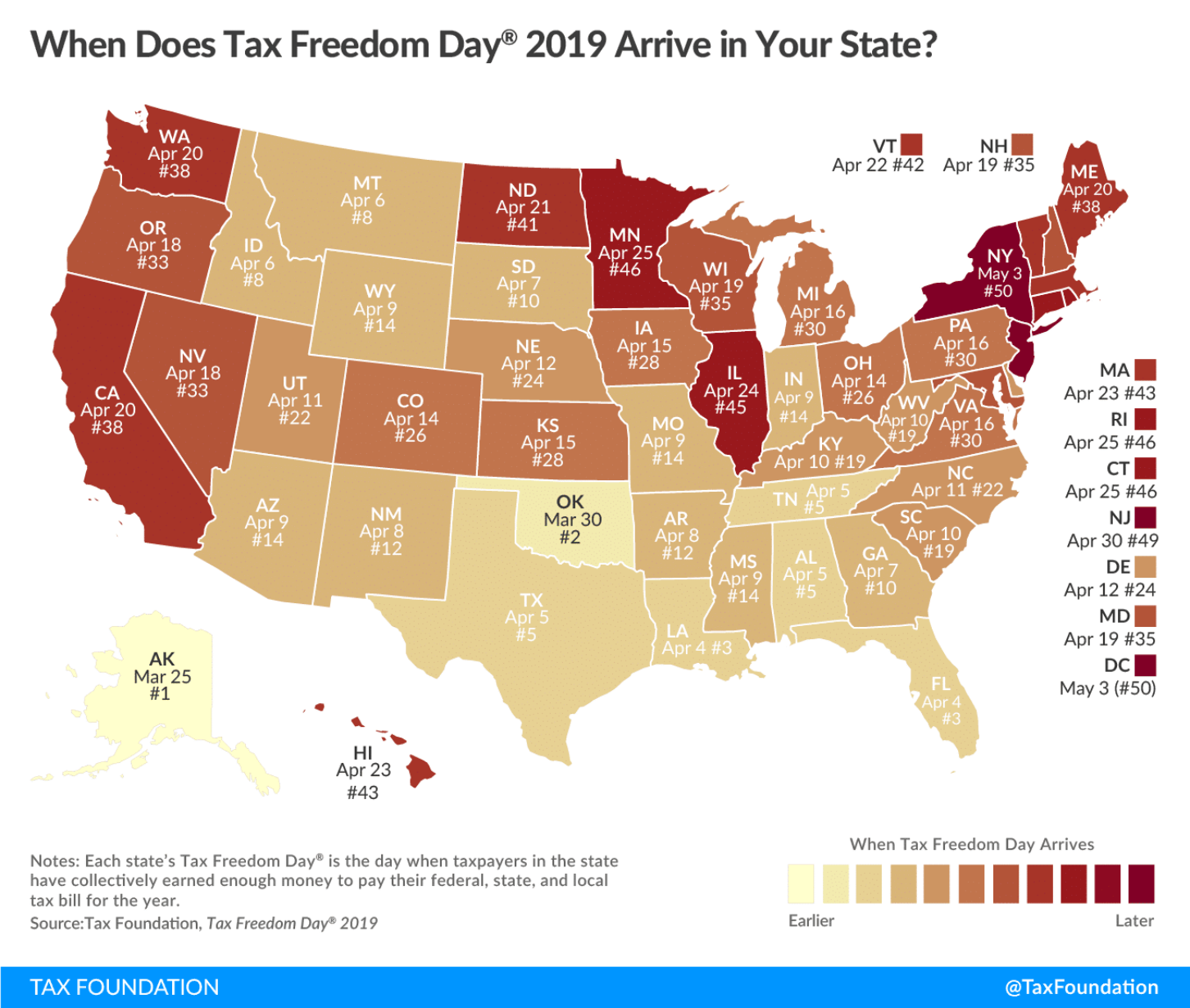

Freedom: Tax Freedom Day, calculated annually by the Tax Foundation, represents how long Americans must to work to pay the nation’s tax burden. This year, Tax Freedom Day falls on April 16, or 105 days into the year. That’s the same as 2018. Tax Freedom Day came early for Georgia, on April 7. Earliest is Alaska, on March 25; latest are Washington, D.C., and New York, on May 3. Including annual federal borrowing, which represents future taxes owed, adds 22 days to the burden.

Debt: As American taxpayers finalize their returns ahead of the April 15 deadline, the Government Accountability Office is warning about the nation’s fiscal future: “Interest on the debt is one of the main causes of future fiscal unsustainability. As of September 30, 2018, 61 percent of the outstanding amount of marketable Treasury securities held by the public (about $9.2 trillion) was scheduled to mature in the next 4 years. Treasury will likely need to refinance these securities at higher interest rates.”

Education

Workaround: With courts blocking Education Secretary Betsy DeVos’ efforts to chisel away at the Obama administration’s education agenda, she is trying a different tactic: not enforcing the rules, according to The Wall Street Journal. The agency was prevented from scaling back measures including a crackdown on the for-profit college industry and a mandate regarding civil rights in special education, so it is slow-walking enforcement, achieving the same effect.

Media

Foundation in the news: Former Foundation President Griff Doyle, who retired this month from the University of Georgia, was honored on the floor of the U.S. House of Representatives by Georgia Congressman Buddy Carter.

Social media: The Foundation’s Facebook page has 3,492 “likes” this week; our Twitter account has 1,892 followers! Join them!

Friday Flashback

This month in the archives: In April 10 years ago, the Foundation published, “Policy-makers Can Still Move on Transportation in Georgia.” It noted, “Deciding whether a project justifies a public-private partnership or a public-sector approach isn’t always easy. But it promotes a limited-government environment and succeeds when government doesn’t relinquish performance oversight.”

Visit www.georgiapolicy.org to read the Foundation’s latest commentary, “Georgia Needs an Earnest Effort at Tax Reform,” by Benita M. Dodd.

Have a great weekend!

Kyle Wingfield and Benita Dodd

FRIDAY FACTS is made possible by the generosity of the Georgia Public Policy Foundation’s donors. If you enjoy the FRIDAY FACTS, please consider making a tax-deductible contribution to help advance our important mission by clicking here. Visit our Web site at www.georgiapolicy.org. Join The Forum at https://forum.georgiapolicy.org/.