President Obama continues to push for an increase in the federal minimum wage but as University of Georgia economist Jeffrey Dorfman explains here, the biggest winners from Obama’s proposal would be government tax collectors.

(This article was published on Forbes.com and is reprinted with permission by the author.)

By Jeffrey Dorfman

Professor of Applied Economics

University of Georgia

President Obama and the Democrats continue to push for an increase in the minimum wage. Against much evidence that such a law is very ineffective at reducing poverty, the administration is still touting the benefits they claim would help millions of workers. Yet, it turns out that, for the sort of worker about whom we should be most concerned, such a policy actually benefits the federal government more than the worker.

That’s right. As I will show below, a hypothetical single mom with one kid would see more than half of the proposed minimum wage increase offset by a reduction in benefits from the federal government and increased taxes. An increase in the minimum wage is great if you keep your job and your family already has too much household income to get welfare benefits, a category of households which is actually quite common. For those actually in or near poverty, however, any gain in wage earnings causes a significant loss in benefits that severely curtails the claimed impact of a minimum wage increase at lifting the working poor out of poverty. Essentially, these workers face the equivalent of a 50 percent or higher tax rate.

To give you some idea of how poorly designed the minimum wage is as an anti-poverty policy, the Congressional Budget Office (CBO) estimates that raising the minimum wage from its current $7.25 per hour to the President’s preferred option of $10.10 per hour will lift only 900,000 people out of poverty from the 45 million currently in poverty. That is a 2 percent success rate. Not exactly making a big dent in poverty, is it?

The same CBO report mentions the issue of the working poor losing some benefits and even makes clear that increasing the Earned Income Tax Credit (EITC) is a more cost-effective anti-poverty policy. However, it does not really make clear exactly how penalizing the loss of income support and food assistance benefits can be.

So, let’s make it really clear. For a hypothetical single mom with one kid, how would an increase in the minimum wage impact total income including government benefits? First, I assume our mom works full-time at the current minimum wage, thus earning about $15,000 per year. That means her family officially lives in poverty. I also assume that she collects the Earned Income Tax Credit, pays no federal income taxes, receives food stamps, and receives a Low Income Home Energy Assistance Program benefit (help with winter utility bills); we can mostly ignore other benefits. I also assume she keeps her job and does not have her hours reduced as a result of the increase in the minimum wage.

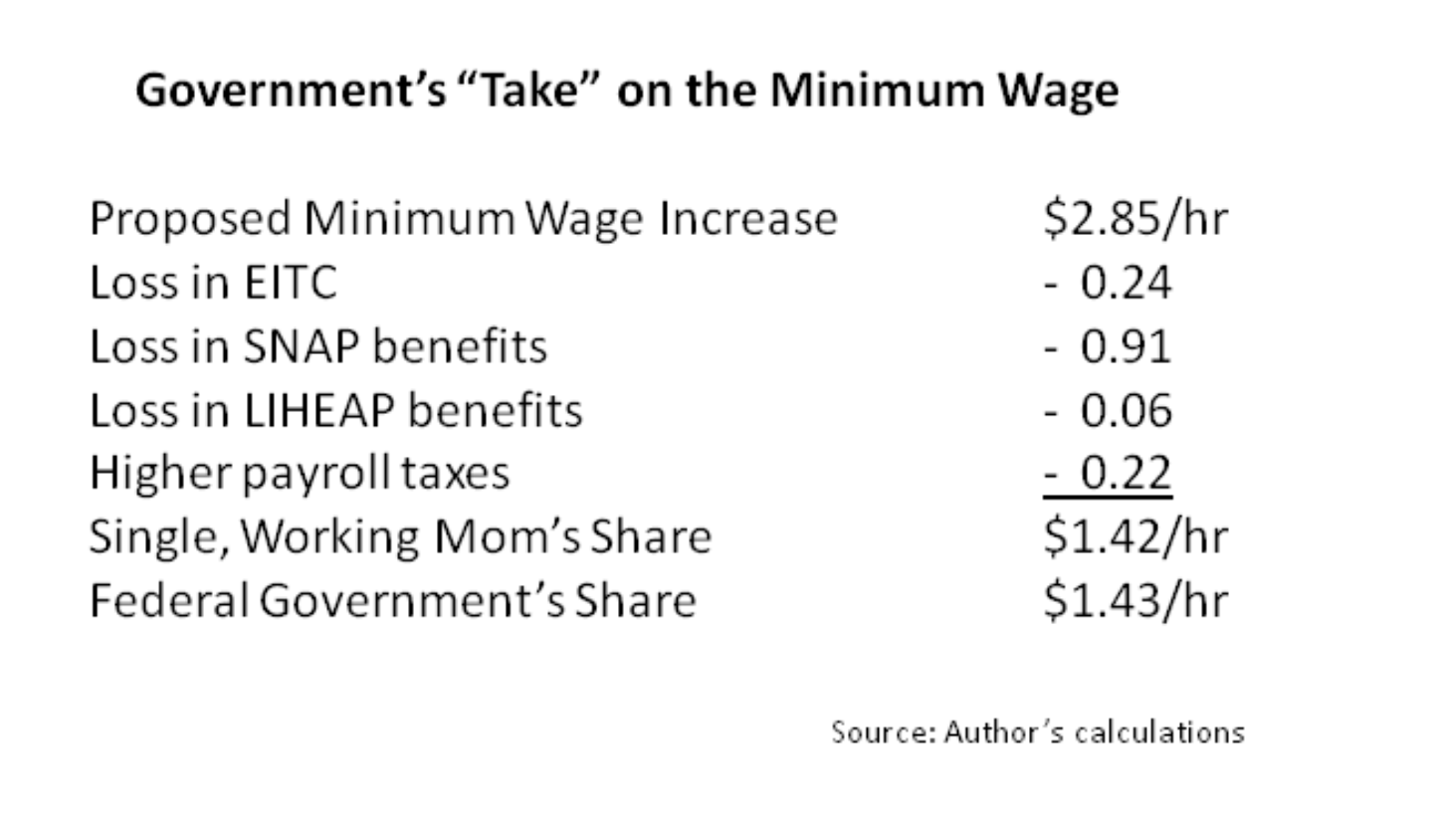

If the minimum wage is raised from $7.25 to $10.10 per hour, the single mom gains $2.85 per hour in extra pay, translating into an extra $494 per month or $5,928 per year in extra wage income. That sounds like a big raise and would officially lift this family out of poverty. It all sounds just like the President says up to this point. But, now let’s make some subtractions.

First, our single working mom’s Earned Income Tax Credit will be reduced by 15.98 percent of any earnings above $17,830 because the credit phases out as extra income is earned. That means our mom loses $0.24 per hour of her $2.85 raise (averaged over all her hours). She also has to pay employment taxes on her new earnings, costing her $0.22 per hour. The increase in earnings would cut her SNAP benefits (food stamps) by an estimated $150 per month which equals another $0.91 per hour.

Calculating the Low Income Home Energy Assistance Program (LIHEAP) benefit change is tricky. However, if we place our single mom in Illinois (President Obama’s home state), her LIHEAP benefit will drop from 50 percent of her expected winter bill to only 40 percent. Based on information provided by the State of Illinois, the smallest change in benefits would be for gas heat, electric falls in the middle, and our mom would lose the most if she had propane or fuel oil as her energy source. I assume electric heat (the middle figure), meaning our mom will lose $126 per year or $0.06 per hour, from the reduction in our heating bill subsidy.

Summing these four offsets, we find that our mom has lost $1.43 of the original $2.85 per hour raise. That means her extra $494 per month is now only $246 and the extra $5,928 per year is really only $2,954. Certainly, our single mom is still better off after an increase in the minimum wage. Amazingly, however, the federal government ended up with 50.2 percent of the extra cost imposed on the employer while our in-poverty, full-time working single mom got to keep only 49.8 percent of the extra money she “earned.”

If our single mom collects any other federal, state, or local benefits that are means-tested, she is likely to lose even more than documented above. In many states, she would be paying at least a small amount in state income taxes which means she would lose some additional money to her state in more income taxes. For example, in Illinois our working mom would pay another $300 in state income taxes, reducing her raise by an additional $0.14 per hour and dropping the share she gets to keep to only 45 percent.

I also assume she has and keeps Medicaid. The minimum wage increased proposed would put her very close to the line. If she loses Medicaid and has to move to Obamacare, our mom will end up way behind, having lost more in benefits than she gained in wages. She could actually be made poorer by a supposed anti-poverty measure.

The minimum wage is an incredibly inefficient way to help the poor because many of the gains go to households that are not in or even near poverty and because the increases in labor costs lead to price increases that must be paid by customers who are often the same low-wage workers supposedly being helped. Still, President Obama has backed that option rather than the seemingly superior policy of increasing the Earned Income Tax Credit. Many, including me, suspect his preference for a minimum wage increase has more to do with the many union contracts that include automatic raises or re-negotiations tied to the minimum wage.

Raising the minimum wage is a bad way to help poor working people. This is well known by everyone involved in economic policy. What is not well known is that if President Obama succeeds in securing the minimum wage increase he is seeking, the government could end up with more than half of the increased pay gained by some of the minimum wage workers he claims to want to help. That means these minimum wage workers face a higher effective tax rate than most people in the top one percent. If this is Democrats’ idea of helping poor people, poor people need to start voting Republican.

(Jeffrey Dorfman is a professor of agricultural and applied economics at the University of Georgia. Dorfman has taught and written about economics for 25 years. This is his first article republished on the Foundation Forum. The views in this article are those of the author and not of the Policy Foundation. This article was originally published by Forbes.com.)

This article was published on Forbes.com and is reprinted with permission by the author.

By Jeffrey Dorfman

JEFFREY DORFMAN

Professor of Applied Economics

University of Georgia

President Obama and the Democrats continue to push for an increase in the minimum wage. Against much evidence that such a law is very ineffective at reducing poverty, the administration is still touting the benefits they claim would help millions of workers. Yet, it turns out that, for the sort of worker about whom we should be most concerned, such a policy actually benefits the federal government more than the worker.

That’s right. As I will show below, a hypothetical single mom with one kid would see more than half of the proposed minimum wage increase offset by a reduction in benefits from the federal government and increased taxes. An increase in the minimum wage is great if you keep your job and your family already has too much household income to get welfare benefits, a category of households which is actually quite common. For those actually in or near poverty, however, any gain in wage earnings causes a significant loss in benefits that severely curtails the claimed impact of a minimum wage increase at lifting the working poor out of poverty. Essentially, these workers face the equivalent of a 50 percent or higher tax rate.

To give you some idea of how poorly designed the minimum wage is as an anti-poverty policy, the Congressional Budget Office (CBO) estimates that raising the minimum wage from its current $7.25 per hour to the President’s preferred option of $10.10 per hour will lift only 900,000 people out of poverty from the 45 million currently in poverty. That is a 2 percent success rate. Not exactly making a big dent in poverty, is it?

The same CBO report mentions the issue of the working poor losing some benefits and even makes clear that increasing the Earned Income Tax Credit (EITC) is a more cost-effective anti-poverty policy. However, it does not really make clear exactly how penalizing the loss of income support and food assistance benefits can be.

So, let’s make it really clear. For a hypothetical single mom with one kid, how would an increase in the minimum wage impact total income including government benefits? First, I assume our mom works full-time at the current minimum wage, thus earning about $15,000 per year. That means her family officially lives in poverty. I also assume that she collects the Earned Income Tax Credit, pays no federal income taxes, receives food stamps, and receives a Low Income Home Energy Assistance Program benefit (help with winter utility bills); we can mostly ignore other benefits. I also assume she keeps her job and does not have her hours reduced as a result of the increase in the minimum wage.

If the minimum wage is raised from $7.25 to $10.10 per hour, the single mom gains $2.85 per hour in extra pay, translating into an extra $494 per month or $5,928 per year in extra wage income. That sounds like a big raise and would officially lift this family out of poverty. It all sounds just like the President says up to this point. But, now let’s make some subtractions.

First, our single working mom’s Earned Income Tax Credit will be reduced by 15.98 percent of any earnings above $17,830 because the credit phases out as extra income is earned. That means our mom loses $0.24 per hour of her $2.85 raise (averaged over all her hours). She also has to pay employment taxes on her new earnings, costing her $0.22 per hour. The increase in earnings would cut her SNAP benefits (food stamps) by an estimated $150 per month which equals another $0.91 per hour.

Calculating the Low Income Home Energy Assistance Program (LIHEAP) benefit change is tricky. However, if we place our single mom in Illinois (President Obama’s home state), her LIHEAP benefit will drop from 50 percent of her expected winter bill to only 40 percent. Based on information provided by the State of Illinois, the smallest change in benefits would be for gas heat, electric falls in the middle, and our mom would lose the most if she had propane or fuel oil as her energy source. I assume electric heat (the middle figure), meaning our mom will lose $126 per year or $0.06 per hour, from the reduction in our heating bill subsidy.

Summing these four offsets, we find that our mom has lost $1.43 of the original $2.85 per hour raise. That means her extra $494 per month is now only $246 and the extra $5,928 per year is really only $2,954. Certainly, our single mom is still better off after an increase in the minimum wage. Amazingly, however, the federal government ended up with 50.2 percent of the extra cost imposed on the employer while our in-poverty, full-time working single mom got to keep only 49.8 percent of the extra money she “earned.”

If our single mom collects any other federal, state, or local benefits that are means-tested, she is likely to lose even more than documented above. In many states, she would be paying at least a small amount in state income taxes which means she would lose some additional money to her state in more income taxes. For example, in Illinois our working mom would pay another $300 in state income taxes, reducing her raise by an additional $0.14 per hour and dropping the share she gets to keep to only 45 percent.

I also assume she has and keeps Medicaid. The minimum wage increased proposed would put her very close to the line. If she loses Medicaid and has to move to Obamacare, our mom will end up way behind, having lost more in benefits than she gained in wages. She could actually be made poorer by a supposed anti-poverty measure.

The minimum wage is an incredibly inefficient way to help the poor because many of the gains go to households that are not in or even near poverty and because the increases in labor costs lead to price increases that must be paid by customers who are often the same low-wage workers supposedly being helped. Still, President Obama has backed that option rather than the seemingly superior policy of increasing the Earned Income Tax Credit. Many, including me, suspect his preference for a minimum wage increase has more to do with the many union contracts that include automatic raises or re-negotiations tied to the minimum wage.

Raising the minimum wage is a bad way to help poor working people. This is well known by everyone involved in economic policy. What is not well known is that if President Obama succeeds in securing the minimum wage increase he is seeking, the government could end up with more than half of the increased pay gained by some of the minimum wage workers he claims to want to help. That means these minimum wage workers face a higher effective tax rate than most people in the top one percent. If this is Democrats’ idea of helping poor people, poor people need to start voting Republican.

Jeffrey Dorfman is a professor of agricultural and applied economics at the University of Georgia. Dorfman has taught and written about economics for 25 years. This is his first article republished on the Foundation Forum. The views in this article are those of the author and not of the Policy Foundation. This article was originally published by Forbes.com.