The Center for Budget and Policy Priorities (CBPP) recently released a new study that purports to show that state taxes have a negligible effect on the decisions of Americans to migrate from one state to another.

By Jonathan Williams, Will Freeland and Ben Wilterdink

The Center for Budget and Policy Priorities (CBPP) recently released a new study that purports to show that state taxes have a negligible effect on the decisions of Americans to migrate from one state to another. The study criticizes research done by Dr. Arthur Laffer, Stephen Moore and Jonathan Williams in the yearly publication, “Rich States, Poor States,” and other publications that arrive at the conclusion that states should seek to adopt competitive tax and fiscal policies as a way of promoting economic growth.

The author of the CBPP report fundamentally misinterprets what the data really means and/or grossly misrepresents the actual position taken by advocates of lower state taxes. For the 43 million Americans who have moved between the states from 1992 to 2011 – bringing $2 trillion with them – economic policy frequently was a major factor.

It is worth pointing out that years of research shows that citizens move based on taxes – and more broadly – economic policy. States with better public policy see higher job growth, higher gross state product growth, and higher migration. Businesses relocate to states with better economic climates and are able to hire more workers when they have more money left over after taxes, regulatory compliance, and legal compliance. That means that citizens looking for a job or higher pay will generally flow to free market states that have enhanced economic competitiveness.

Looking at the performance over the last decade of the top and bottom 10 states from this year’s, “Rich States, Poor States,” demonstrates this migration trend:

Furthermore, Dr. Randall Pozdena and Eric Fruits have shown that states that have a higher performance in, “Rich States, Poor States,” have stronger economic health. They find that economic freedom, as measured by the, “Rich States, Poor States,” economic outlook rankings, accounts for 25-40 percent of the variation in state economic performance.

The author of the CBPP report makes much of the fact that people who move from one state to another do not explicitly cite “taxes” as the reason for the move when asked. From this data point, the author concludes that taxes have very little impact on whether people will move from one state to another when in fact, the leading reason people move is for a job.

First, just because high taxes were not cited as the primary reason to move to another state does not mean that taxes were not taken into account and considered among various other factors. Second, even the author of the CBPP study acknowledges there are indeed cases where people move from one state to another primarily for tax purposes. Take an individual moving from California to Texas: Higher income earners stand to pay no income tax instead of a top marginal rate of 13.3 percent. Third, the CBPP conclusion tremendously mischaracterizes the position of those who advocate for lowering state taxes.

To paraphrase the core arguments made in, “Rich States, Poor States:”

- Incentives matter: people will generally act in their own best interest

- Lower state taxes and other policy decisions are important to economic growth

- Economic growth means more opportunity and prosperity for citizens, including new and better jobs

The data show that people will move to a state if they have reason to believe they will have better opportunities in that state, and an economic climate that is conducive to greater economic growth includes competitive state taxes.

Even the CBPP author acknowledges this point, noting that, statistically, nearly a third of people report they are moving or moved for a job. The real question here should have been: Does having lower state taxes mean more economic growth and more jobs? The answer is an unequivocal yes.

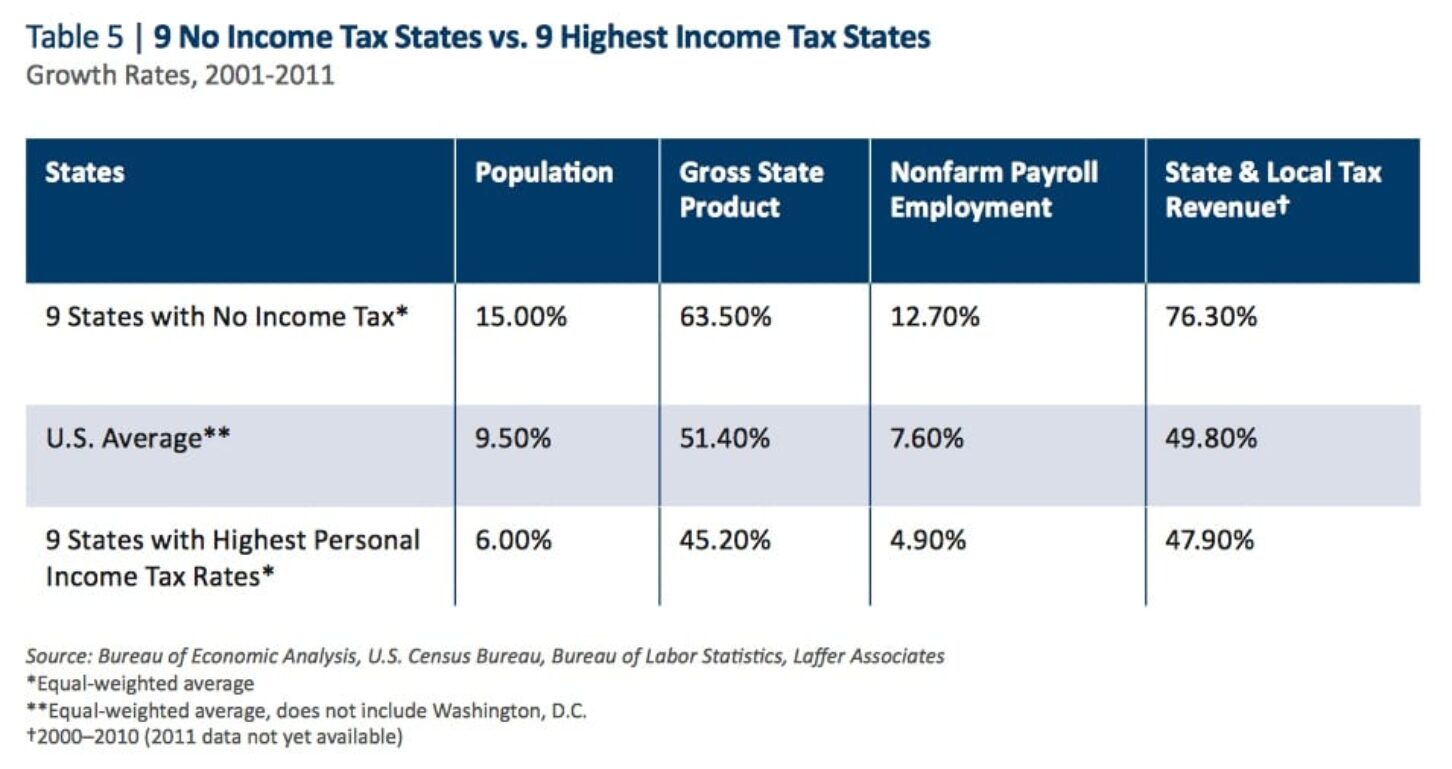

The facts show that states with low taxes, especially low or no income taxes, consistently outperform their high-tax counterparts in terms of economic growth, which includes job growth and domestic migration. The table below succinctly lays out a comparison between the nine states that have no income tax versus the nine states with the highest income taxes. Clearly, the no-income tax states are doing far better than their high-tax counterparts. Public policy, including tax policy, matters to economic performance, which in turn matters to migration.

The CBPP report ultimately fails to prove what it sets out to explain: that taxes don’t matter to Americans’ interstate moving decisions. The author’s various arguments for why we see the moving patterns that we do lack sufficient explanatory power to reject the conclusion that taxes matter for domestic migration, even if indirectly.

As, “Rich States, Poor States,” has documented, there are years of data demonstrating how low-tax states are far more conducive to economic growth than their high-tax counterparts. Economic growth means more jobs and more opportunity, and we know that people move for better jobs and better opportunity.

This commentary is excerpted from, “Taxes Do Matter to Migration,” by ALEC’s Center for State Fiscal Reform. Read the entire article at http://www.americanlegislator.org/policy-matters/.

By Jonathan Williams, Will Freeland and Ben Wilterdink

The Center for Budget and Policy Priorities (CBPP) recently released a new study that purports to show that state taxes have a negligible effect on the decisions of Americans to migrate from one state to another. The study criticizes research done by Dr. Arthur Laffer, Stephen Moore and Jonathan Williams in the yearly publication, “Rich States, Poor States,” and other publications that arrive at the conclusion that states should seek to adopt competitive tax and fiscal policies as a way of promoting economic growth.

The author of the CBPP report fundamentally misinterprets what the data really means and/or grossly misrepresents the actual position taken by advocates of lower state taxes. For the 43 million Americans who have moved between the states from 1992 to 2011 – bringing $2 trillion with them – economic policy frequently was a major factor.

It is worth pointing out that years of research shows that citizens move based on taxes – and more broadly – economic policy. States with better public policy see higher job growth, higher gross state product growth, and higher migration. Businesses relocate to states with better economic climates and are able to hire more workers when they have more money left over after taxes, regulatory compliance, and legal compliance. That means that citizens looking for a job or higher pay will generally flow to free market states that have enhanced economic competitiveness.

Looking at the performance over the last decade of the top and bottom 10 states from this year’s, “Rich States, Poor States,” demonstrates this migration trend:

Furthermore, Dr. Randall Pozdena and Eric Fruits have shown that states that have a higher performance in, “Rich States, Poor States,” have stronger economic health. They find that economic freedom, as measured by the, “Rich States, Poor States,” economic outlook rankings, accounts for 25-40 percent of the variation in state economic performance.

The author of the CBPP report makes much of the fact that people who move from one state to another do not explicitly cite “taxes” as the reason for the move when asked. From this data point, the author concludes that taxes have very little impact on whether people will move from one state to another when in fact, the leading reason people move is for a job.

First, just because high taxes were not cited as the primary reason to move to another state does not mean that taxes were not taken into account and considered among various other factors. Second, even the author of the CBPP study acknowledges there are indeed cases where people move from one state to another primarily for tax purposes. Take an individual moving from California to Texas: Higher income earners stand to pay no income tax instead of a top marginal rate of 13.3 percent. Third, the CBPP conclusion tremendously mischaracterizes the position of those who advocate for lowering state taxes.

To paraphrase the core arguments made in, “Rich States, Poor States:”

- Incentives matter: people will generally act in their own best interest

- Lower state taxes and other policy decisions are important to economic growth

- Economic growth means more opportunity and prosperity for citizens, including new and better jobs

The data show that people will move to a state if they have reason to believe they will have better opportunities in that state, and an economic climate that is conducive to greater economic growth includes competitive state taxes.

Even the CBPP author acknowledges this point, noting that, statistically, nearly a third of people report they are moving or moved for a job. The real question here should have been: Does having lower state taxes mean more economic growth and more jobs? The answer is an unequivocal yes.

The facts show that states with low taxes, especially low or no income taxes, consistently outperform their high-tax counterparts in terms of economic growth, which includes job growth and domestic migration. The table below succinctly lays out a comparison between the nine states that have no income tax versus the nine states with the highest income taxes. Clearly, the no-income tax states are doing far better than their high-tax counterparts. Public policy, including tax policy, matters to economic performance, which in turn matters to migration.

The CBPP report ultimately fails to prove what it sets out to explain: that taxes don’t matter to Americans’ interstate moving decisions. The author’s various arguments for why we see the moving patterns that we do lack sufficient explanatory power to reject the conclusion that taxes matter for domestic migration, even if indirectly.

As, “Rich States, Poor States,” has documented, there are years of data demonstrating how low-tax states are far more conducive to economic growth than their high-tax counterparts. Economic growth means more jobs and more opportunity, and we know that people move for better jobs and better opportunity.

This commentary is excerpted from, “Taxes Do Matter to Migration,” by ALEC’s Center for State Fiscal Reform. Read the entire article at http://www.americanlegislator.org/policy-matters/.