By Kelly McCutchen

Rising health care costs are squeezing middle-class families, as this chart published b y the Wall Street Journal based on Brookings Institution analysis clearly shows.

y the Wall Street Journal based on Brookings Institution analysis clearly shows.

These families could care less about AHCA vs ACA, they just want some relief.

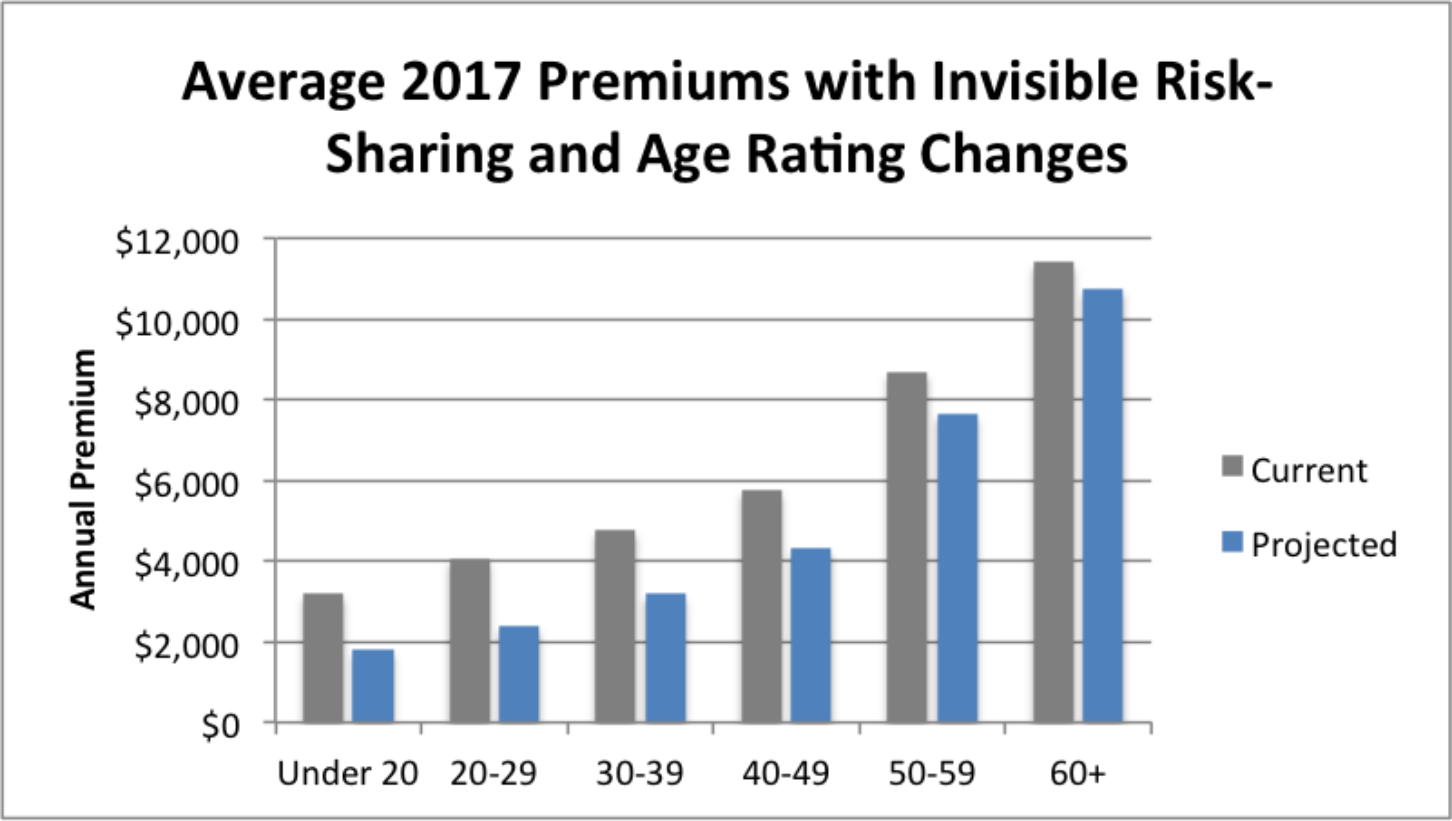

The good news is that a new analysis shows that implementing the reforms in the American Health Care Act (AHCA) that was passed in the U.S. House of Representatives today will lower premiums across the board.

The analysis by the Milliman actuarial firm analyzed the impact of changing the 3:1 age rating limit in the Affordable Care Act (ACA) to the 5:1 ratio in the AHCA bill and implementing an Invisible Risk-Sharing Program (also known as an Invisible High-Risk Pool), which is included in the AHCA bill. Health Affairs also published a recent article on this topic.

The AHCA bill currently includes refundable tax credits that vary by age from $2,000 to $4,000. These credits would completely or almost completely pay for these lower premiums for those under age 50. The House set aside $85 billion in the AHCA bill to allow the Senate to increase the tax credits to address this gap for older Americans. The age rating requirements in the AHCA bill allow premiums for the oldest plan members to be five times higher than premiums for the youngest adult plan members, which roughly equals the difference in health care costs for those groups. It would make sense for the Senate to reset the upper tax credit to five times higher than the lowest tax credit.

Cost: The Milliman analysis calculates the cost of the Invisible Risk Sharing Program will be $3.3 billion per year. The AHCA bill has allocated an average of $12.3 billion per year that is available to help fund measures to reduce premiums, which appears to be more than sufficient.

High-Risk Pools: A more popular way to address the cost of people with pre-existing conditions is with a high-risk pool. In fact, the Foundation has promoted this concept for many years.

According to the National Conference of State Legislators, “35 states set up high-risk health insurance pools over a 25 year span, from 1976 to 2009. Across these 35 states, the national enrollment was 226,615 by December 31, 2011.” In addition, the ACA created federally funded high-risk pools that were active from 2010 through 2014.

At the peak of Georgia’s enrollment in the federal high-risk pool in February of 2013, 3,958 were enrolled at a cost of $96 million. (Peak enrollment nationally was 114,959.) The federal pool charged standard rates, as opposed to most state high-risk pools that charged 125%-200% of standard rates.

Georgia is projected to receive $700 million through the AHCA Patient and State Stability Fund. (This calculation was published before the Fund was increased by a late amendment to the bill that added $8 billion over five years.)

The Center for the American Experiment has compared the cost of state high-risk pools with estimates of funding from the AHCA bill. According to the report, “The main knock agaist old high-risk pools was that they didn’t have enough funding to deliver adequate coverage. This was indeed true. The AHCA does not make this mistake. Comparing the federal funding available to states in 2018 for high-risk programs against the amount states spent on high-risk pools in 2011 shows a dramatic increase in funding.”

Regardless of what happens in Congress, it will be necessary to look at every option available to lower premiums so middle-class families can afford health insurance. Both reinsurance and high-risk pools, if funded properly, can help subsidize individuals with pre-existing conditions while limiting the negative impact on premiums.

Glossary:

Invisible High Risk Pool: The Federal Invisible High Risk Pool (FIHRP) is a proposed risk sharing/transfer mechanism to cover certain high-cost claimants in the individual health insurance market that also facilitates coverage for those with pre-existing conditions. Introduced as an amendment to the American Health Care Act of 2017 (AHCA), the FIHRP creates a high risk pool that covers claims for persons whose insured plan benefits exceed $10,000 per year; those healthcare providers are paid at a lower rate than what commercial carriers typically negotiate. The FIHRP is funded by a combination of carrier premium contributions along with proceeds from the Patient and State Stability Fund. (Definition from the Milliman study.)

Reinsurance: A reimbursement system that protects insurers from very high claims. It usually involves a third party paying part of an insurance company’s claims once they pass a certain amount. Reinsurance is a way to stabilize an insurance market and make coverage more available and affordable.

Patient and State Stability Fund: This fund is established with federal funding of $130 billion over 9 years, and additional funding of $8 billion over 5 years for states that elect community rating waivers. States may use funds to provide financial help to high-risk individuals, promote access to preventive services, provide cost sharing subsidies, and for other purposes. In 2020, $15 billion of funds shall be used only for services related to maternity coverage and newborn care, and mental health and substance use disorders. For 2018-2026, $15 billion is allocated for Federal Invisible Risk Sharing Program (reinsurance) grants to states. In states that don’t successfully apply for grants, funds will be used for reinsurance program. For 2018-2023, $8 billion shall only be used by states electing community rating waivers to provide assistance to reduce premiums or other out of pocket costs for individuals who are subject to higher premiums as a result of the community rating waiver. (Definition from the bill summary.)

By Kelly McCutchen

Rising health care costs are squeezing middle-class families, as this chart published b y the Wall Street Journal based on Brookings Institution analysis clearly shows.

y the Wall Street Journal based on Brookings Institution analysis clearly shows.

These families could care less about AHCA vs ACA, they just want some relief.

The good news is that a new analysis shows that implementing the reforms in the American Health Care Act (AHCA) that was passed in the U.S. House of Representatives today will lower premiums across the board.

The analysis by the Milliman actuarial firm analyzed the impact of changing the 3:1 age rating limit in the Affordable Care Act (ACA) to the 5:1 ratio in the AHCA bill and implementing an Invisible Risk-Sharing Program (also known as an Invisible High-Risk Pool), which is included in the AHCA bill. Health Affairs also published a recent article on this topic.

The AHCA bill currently includes refundable tax credits that vary by age from $2,000 to $4,000. These credits would completely or almost completely pay for these lower premiums for those under age 50. The House set aside $85 billion in the AHCA bill to allow the Senate to increase the tax credits to address this gap for older Americans. The age rating requirements in the AHCA bill allow premiums for the oldest plan members to be five times higher than premiums for the youngest adult plan members, which roughly equals the difference in health care costs for those groups. It would make sense for the Senate to reset the upper tax credit to five times higher than the lowest tax credit.

Cost: The Milliman analysis calculates the cost of the Invisible Risk Sharing Program will be $3.3 billion per year. The AHCA bill has allocated an average of $12.3 billion per year that is available to help fund measures to reduce premiums, which appears to be more than sufficient.

High-Risk Pools: A more popular way to address the cost of people with pre-existing conditions is with a high-risk pool. In fact, the Foundation has promoted this concept for many years.

According to the National Conference of State Legislators, “35 states set up high-risk health insurance pools over a 25 year span, from 1976 to 2009. Across these 35 states, the national enrollment was 226,615 by December 31, 2011.” In addition, the ACA created federally funded high-risk pools that were active from 2010 through 2014.

At the peak of Georgia’s enrollment in the federal high-risk pool in February of 2013, 3,958 were enrolled at a cost of $96 million. (Peak enrollment nationally was 114,959.) The federal pool charged standard rates, as opposed to most state high-risk pools that charged 125%-200% of standard rates.

Georgia is projected to receive $700 million through the AHCA Patient and State Stability Fund. (This calculation was published before the Fund was increased by a late amendment to the bill that added $8 billion over five years.)

The Center for the American Experiment has compared the cost of state high-risk pools with estimates of funding from the AHCA bill. According to the report, “The main knock agaist old high-risk pools was that they didn’t have enough funding to deliver adequate coverage. This was indeed true. The AHCA does not make this mistake. Comparing the federal funding available to states in 2018 for high-risk programs against the amount states spent on high-risk pools in 2011 shows a dramatic increase in funding.”

Regardless of what happens in Congress, it will be necessary to look at every option available to lower premiums so middle-class families can afford health insurance. Both reinsurance and high-risk pools, if funded properly, can help subsidize individuals with pre-existing conditions while limiting the negative impact on premiums.

Glossary:

Invisible High Risk Pool: The Federal Invisible High Risk Pool (FIHRP) is a proposed risk sharing/transfer mechanism to cover certain high-cost claimants in the individual health insurance market that also facilitates coverage for those with pre-existing conditions. Introduced as an amendment to the American Health Care Act of 2017 (AHCA), the FIHRP creates a high risk pool that covers claims for persons whose insured plan benefits exceed $10,000 per year; those healthcare providers are paid at a lower rate than what commercial carriers typically negotiate. The FIHRP is funded by a combination of carrier premium contributions along with proceeds from the Patient and State Stability Fund. (Definition from the Milliman study.)

Reinsurance: A reimbursement system that protects insurers from very high claims. It usually involves a third party paying part of an insurance company’s claims once they pass a certain amount. Reinsurance is a way to stabilize an insurance market and make coverage more available and affordable.

Patient and State Stability Fund: This fund is established with federal funding of $130 billion over 9 years, and additional funding of $8 billion over 5 years for states that elect community rating waivers. States may use funds to provide financial help to high-risk individuals, promote access to preventive services, provide cost sharing subsidies, and for other purposes. In 2020, $15 billion of funds shall be used only for services related to maternity coverage and newborn care, and mental health and substance use disorders. For 2018-2026, $15 billion is allocated for Federal Invisible Risk Sharing Program (reinsurance) grants to states. In states that don’t successfully apply for grants, funds will be used for reinsurance program. For 2018-2023, $8 billion shall only be used by states electing community rating waivers to provide assistance to reduce premiums or other out of pocket costs for individuals who are subject to higher premiums as a result of the community rating waiver. (Definition from the bill summary.)

Kelly McCutchen is president of the Georgia Public Policy Foundation.