By William McBride

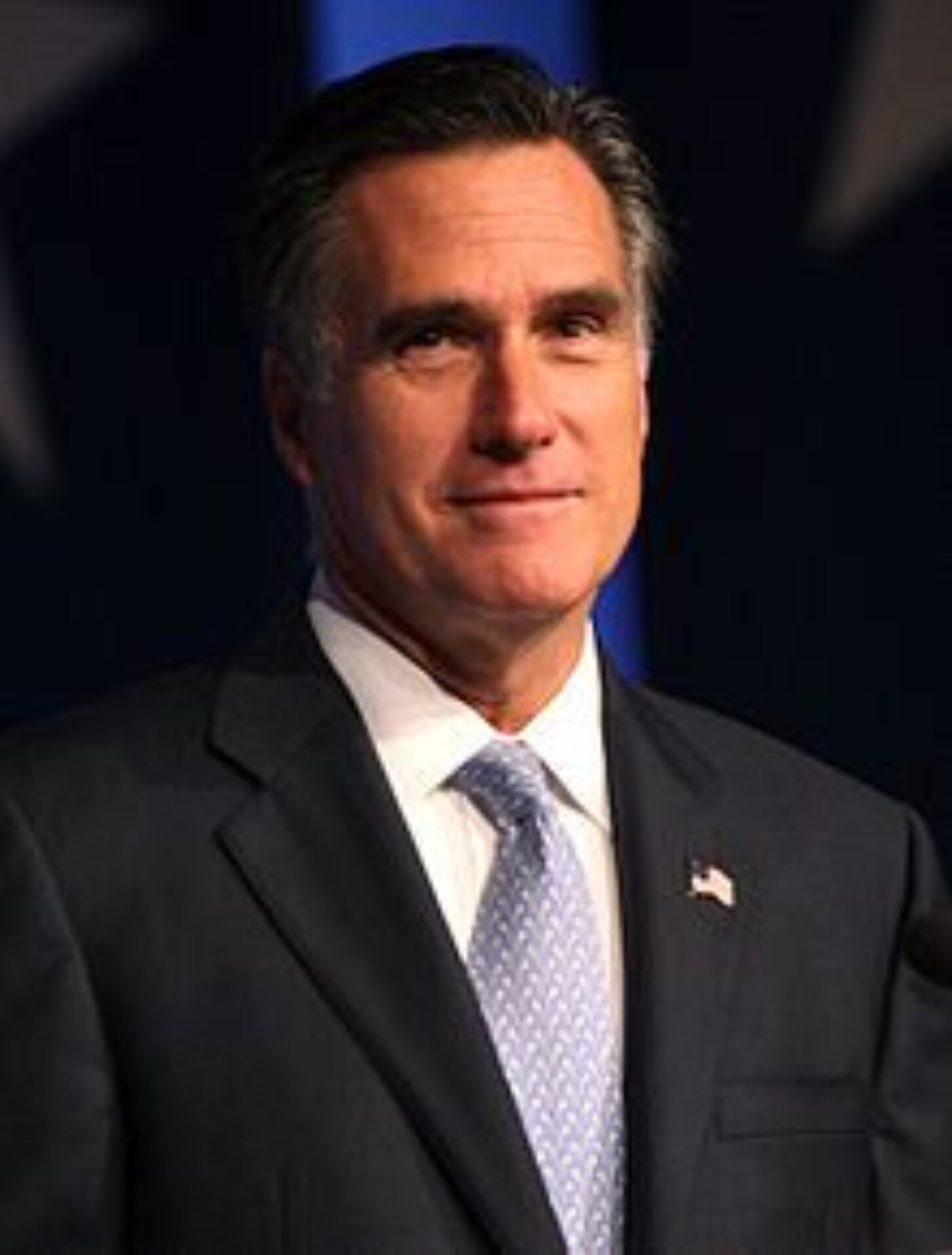

The Tax Policy Center (TPC) has a new paper that claims Mitt Romney’s tax plan necessarily leads to lower taxes on high-income earners and higher taxes on everyone else:

“Our major conclusion is that a revenue-neutral individual income tax change that incorporates the features Governor Romney has proposed – including reducing marginal tax rates substantially, eliminating the individual alternative minimum tax (AMT) and maintaining all tax breaks for saving and investment – would provide large tax cuts to high-income households, and increase the tax burdens on middle- and/or lower-income taxpayers. This is true even when we bias our assumptions about which and whose tax expenditures are reduced to make the resulting tax system as progressive as possible. For instance, even when we assume that tax breaks – like the charitable deduction, mortgage interest deduction, and the exclusion for health insurance – are completely eliminated for higher-income households first, and only then reduced as necessary for other households to achieve overall revenue-neutrality– the net effect of the plan would be a tax cut for high-income households coupled with a tax increase for middle-income households.

In addition, we also assess whether these results hold if we assume that revenue reductions are partially offset by higher economic growth. Although reasonable models would show that these tax changes would have little effect on growth, we show that even with implausibly large growth effects, revenue neutrality would still require large reductions in tax expenditures and would likely result in a net tax increase for lower- and middle-income households and tax cuts for high-income households.”

The main thing missing here is the context of our current federal income tax code. Imagine a society with 5 people, where the two richest people pay all the taxes, the middle person pays nothing, and the two poorest people actually have a negative tax rate, meaning the rich are paying them through the tax code. Then any cut in the tax rate will disproportionately benefit the rich guys. This is the federal income tax code, in a nutshell. According to the CBO, the top 20 percent of households pays 94 percent of federal income taxes. The bottom 40 percent actually have a negative income tax rate, and the middle quintile pays close to zero. See the two charts below.

The CBO finds that progressivity, or redistribution through the income tax code, is at a record high. This is mainly due to the accumulation of low-income provisions, particularly refundable tax credits such as the Earned Income Tax Credit and the Child Credit. This is pretty exceptional from a global perspective. The OECD finds that we have themost progressive income tax system in the industrialized world. In this context, it is well past time to consider the costs and benefits of such an extremely progressive system.

One major cost of progressivity is economic growth. High-income earners do a disproportionate amount of the saving, investing, entrepreneurship, and high-productivity labor, while low-income earners do a disproportionate amount of the consumption. Extreme progressivity is certainly contributing to a situation where the U.S. nowconsumes nearly everything it produces, while investment and growth suffers.

(Click here to view charts and continue reading this article on the Tax Foundation website.)